At CEF Insider, we reside for these instances when a nasty information story turns up an ideal dividend alternative. And the headlines simply served one up, placing a 12%+ dividend (in a hated sector, no much less) on the desk.

This particular scenario is intriguing as a result of nobody in America is speaking about it. That is as a result of it comes from throughout the pond, within the UK. Particularly, I am speaking about one of many UK’s greatest insurers, Phoenix Group, pulling GBP22 billion (US$30 billion) from asset supervisor Aberdeen Group plc (SLFPY), reportedly to handle these funds in-house.

Aberdeen’s title would possibly ring a bell in the event you’re a CEF Insider member, as we have held the agency’s funds prior to now. It is one of many world’s largest closed-end fund (CEF) managers.

The transfer comes as Aberdeen has been affected by poor efficiency, destructive headlines and slipping analyst sentiment.

You’ll be able to see that within the efficiency of two of Aberdeen’s worldwide CEFs, the abrdn World Premier Properties Fund (AWP), in purple beneath, and abrdn World Infrastructure Earnings Fund (ASGI) (in orange).

Each have flopped in relation to a benchmark worldwide ETF, in blue, within the final 5 years:

Two Key Aberdeen CEFs Lag Their Benchmarks …

(The corporate rebranded from “Aberdeen” to “abrdn” a number of years in the past, and recently–and wisely–went again to “Aberdeen” in March. The agency’s CEFs do not seem to have been relabeled but.)

Which brings me to these two 12%+-paying Aberdeen “diamonds within the tough”: abrdn Healthcare Traders (HQH), with a 12.4% yield, and 12.7%-paying abrdn Healthcare Alternatives Fund (THQ). These are a bit distinctive in that Aberdeen acquired them pretty lately: on the finish of October 2023, to be exact.

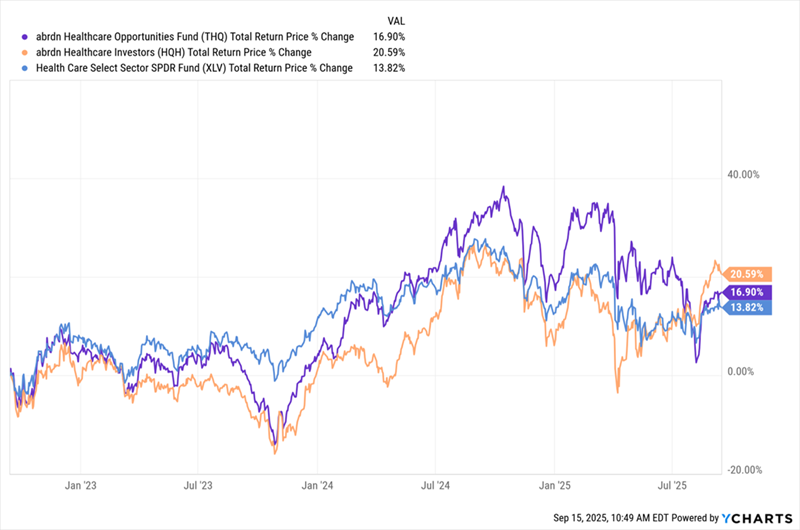

Earlier than that, each had been owned by Tekla Healthcare Administration and run by a staff that included each medical researchers and monetary professionals. The proof of that strategy is, as they are saying, within the pudding. As you possibly can see beneath, over the past three years, each HQH (in orange beneath) and THQ (in purple) have overwhelmed the benchmark pharma ETF (in blue), though the return on all three has been mediocre at greatest:

THQ, HQH, Beat the Index in a Powerful Atmosphere

Healthcare has been weighed down–especially this year–with the appointment of RFK Jr. as head of the HHS, the specter of tariffs on imported prescription drugs and stress from the Trump administration to chop drug costs. However there are indicators this pessimism could also be overdone, organising the primary a part of our alternative:

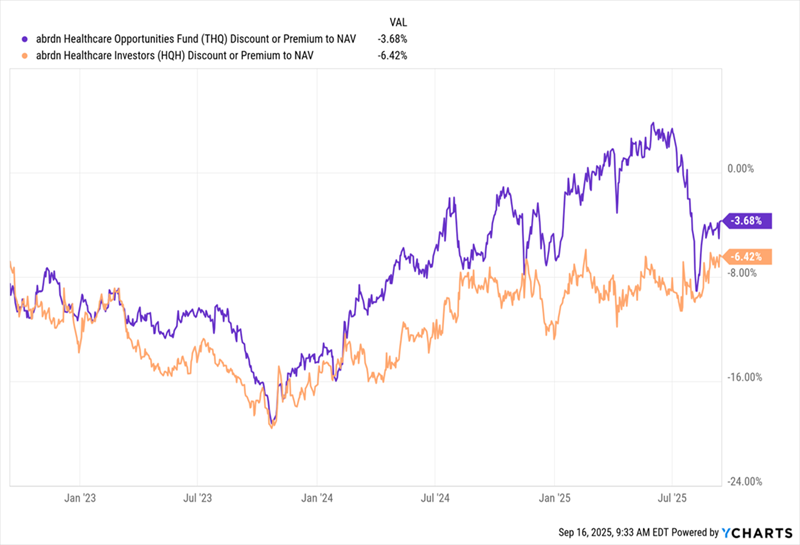

HQH, THQ Have “Low cost Momentum”

Above we see the reductions to web asset worth (NAV, or the worth of their underlying holdings) on THQ (once more in purple) and HQH (in orange).

As you possibly can see, these markdowns have been narrowing in the previous couple of years, even with THQ vaulting into premium territory, solely to see that premium collapse. These “discounts-with-momentum” are the second a part of our purchase case right here.

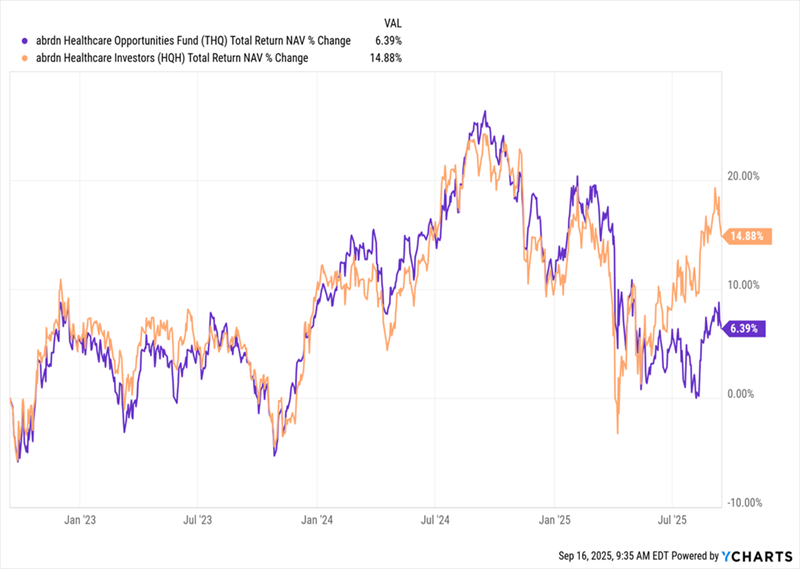

Now let us take a look at every fund’s NAV efficiency, as a result of we are able to clearly see that HQH’s complete NAV return (in orange beneath)–or the efficiency of its underlying portfolio, together with dividends collected and reinvested–outstrips that of THQ (in purple).

HQH’s Portfolio Good points, Regardless of Its Deep Low cost

And HQH is cheaper, too, with that 6.4% low cost in comparison with 3.7% for THQ.

A greater-performing portfolio and a deeper low cost? That will get our consideration!

Because of this it is sensible to dip a toe in HQH proper now. Not solely are you getting a 12.7% dividend, however you are getting an even bigger low cost, too. And I do see that low cost persevering with to slim, placing an additional carry below the inventory. That markdown may additionally slam shut fairly shortly if the dour temper round pharma brightens–even a bit.

Furthermore, HQH’s portfolio is much less dangerous than these of different biotech funds. Its prime place is within the large-cap Amgen (AMGN), whereas its top-10 holdings embody well-known companies like Vertex Prescribed drugs (VRTX) and Eli Lilly (LLY).

The truth that it is a well-established fund holding well-established shares provides one other component of safety–and another excuse why its low cost ought to preserve narrowing. Traders who purchase now will take pleasure in some good dividends whereas they wait.

However all that mentioned, there’s one destructive concerning the fund that is holding me from giving it a full-throated advice at this time.

I actually wish to see a month-to-month payout to go along with that prime yield, and HQH pays quarterly.

That issues for causes that transcend comfort: Truth is, any administration staff with the heart to supply a month-to-month payout is assured they’ll preserve that money stream rolling out.

Which is one motive why I urge you to select up 5 prime CEF picks from the portfolio of my CEF Insider service as a substitute.

Yours Now: My Prime 5 Month-to-month Dividend CEFs (10.2% Yields, 20% Upside Forward)

My prime 5 month-to-month dividend funds yield a stout 10.2% at this time. They usually’re cheap–so a lot in order that I see 20%+ capital features potential from them within the subsequent 12 months.

The time to purchase them is now, as a result of the longer you wait, the extra month-to-month payouts you will miss.

I’ve ready a Particular Investor Bulletin that tells you extra about these 5 10.2% month-to-month dividend performs and offers you entry to an unique FREE report revealing their names and tickers. Click on right here to study extra about these funds get your FREE report–and get lined as much as accumulate their subsequent huge payout.

Additionally see:

Warren Buffett Dividend Shares

Dividend Development Shares: 25 Aristocrats

Future Dividend Aristocrats: Shut Contenders

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.