The publish High Altcoins To Purchase At present: XRP, SOL, BONK, HYPE, TRX, ENS, And TON Lead The Altseason Surge appeared first on Coinpedia Fintech Information

XRP, Solana, BONK, Hyperliquid, TRX, and ENS are dominating dealer focus right this moment as on-chain momentum and breakout patterns gas a wave of altcoin consideration.

In Transient:

Solana (SOL), BONK, Hyperliquid (HYPE), TRON (TRX), and Ethereum Title Service (ENS) prime right this moment’s crypto mindshare charts.

Solana’s market cap has formally crossed the $100 billion mark, reinforcing its place as a prime Layer-1 as capital rotation into altcoins intensifies this cycle.

HYPE, TRX, and ENS comply with with robust on-chain and chart-based momentum.

All 5 cash present compelling setups: breakouts, patterns, and whale accumulation.

As Bitcoin units the stage for a possible breakout, altcoins are flashing robust indicators throughout a number of sectors. Listed here are 7 tokens heating up forward of the following main transfer.

International Curiosity in Altcoins Surges as Bitcoin Derivatives Flash Bullish

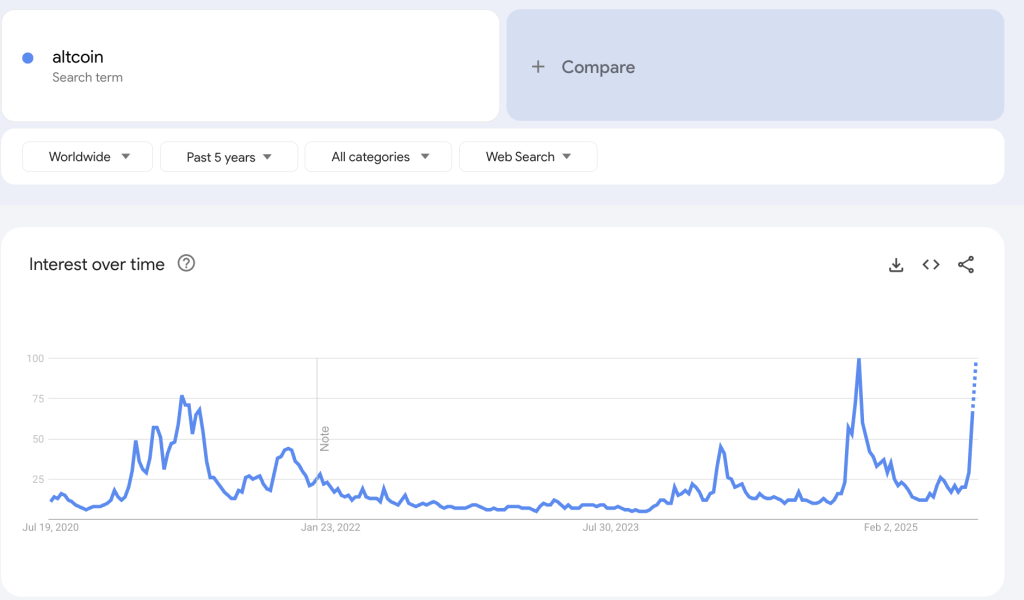

Altcoin curiosity is booming once more — not simply amongst merchants, however throughout the web. In accordance with Google Traits knowledge, world searches for “Altcoins” at the moment are at their highest ranges since early February 2025, indicating renewed public curiosity and capital rotation past Bitcoin.

The sample mirrors previous cycles, the place Bitcoin’s preliminary breakout triggered a follow-up altseason pushed by hypothesis, new tech rollouts, and explosive upside in smaller-cap tokens.

Solana (SOL) – Inverse Head and Shoulders Sample Ignites Rally

Solana ( SOL) is as soon as once more on the centre of market consideration. Its day by day mindshare surged by over 125% crossing the 100 Billion MCAP mark , pushed by robust technical construction and ecosystem tailwinds.

The standout chart formation? A transparent inverse head and shoulders sample, signalling a possible pattern reversal and breakout.

SOLUSD Technical Evaluation

Solana just lately broke out above its neckline resistance round $184–$187, finishing an inverse head and shoulders formation.

The top bottomed out close to $104, making the measured transfer from head to neckline roughly $80. This tasks a goal vary close to $260–$270, aligning with key Fibonacci extensions and historic resistance zones.

Neckline zone: $184–$187

Breakout goal: $260–$270

Assist: $184 (neckline retest), $167

Resistance forward: $219.98, $245.22, $260.01

What’s Fueling the Momentum?

Jito’s BAM (Bid Public sale Mechanism) has reignited DeFi liquidity on Solana, drawing in vital capital from MEV contributors.

This mechanism, which permits validators to public sale off blockspace bids, boosts yield and incentivizes environment friendly community utilization.

Solana can also be seeing elevated TVL and quantity throughout prime dApps like MarginFi and Phoenix.

Analysts spotlight rising institutional consideration and speculative chatter a few potential spot ETF as oblique sentiment boosts.

Solana’s construction mirrors previous cycle setups, making this breakout one of the vital technically validated strikes amongst majors this week.

XRP Breaks Out as CLARITY Act Triggers Institutional Surge

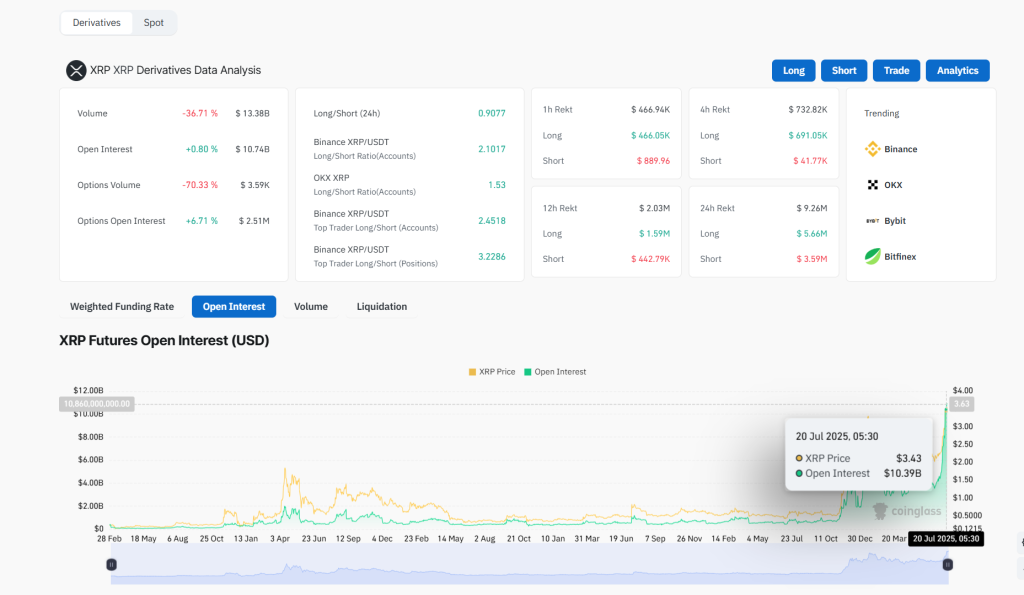

XRP has entered a parabolic rally, breaking firmly above $3.38 after the U.S. Home handed the CLARITY Act, resolving SEC-CFTC jurisdiction battles and clearing the way in which for wider institutional participation and alternate onboarding.

Worth is now consolidating round $3.47, testing the higher sure of a rising wedge formation. Quick resistance lies at $3.63, with breakout targets extending towards the $4.20–$4.40 zone — ranges not seen since XRP’s prior bull cycle peak.

From a technical perspective:

XRP is holding above the important thing Fib 0.236 degree at $3.17, reinforcing bullish construction.

Quantity and pattern strain stay robust, supported by a steep uptrend and beneficial risk-reward at present help zones ($3.17 and $3.00).

On-chain derivatives knowledge confirms the conviction. XRP open curiosity has surged to an all-time excessive of $11.19B, with lengthy/brief ratios exceeding 3.2 throughout Binance and OKX.

Whereas buying and selling quantity has dipped barely, choices open curiosity and funding exercise stay bullish, signalling sustained curiosity in lengthy setups.

A brief-term pullback stays attainable, particularly if the rising wedge construction performs out. Nevertheless, robust help at $3.00–$3.17 presents high-probability re-entry ranges for momentum merchants.

If the $3.38 breakout degree continues to carry, XRP seems well-positioned to revisit $4.20+, with sentiment, construction, and derivatives all aligning for a doubtlessly historic transfer.

Sui (SUI) Builds a Bullish Flag—A $5 Breakout on the Horizon?

SUI is forming a basic bullish flag after rallying 44% from $2.95 to $4.25. Worth is now consolidating inside a downward-sloping channel between $3.90–$4.25, on declining quantity — a typical continuation setup.

A breakout above $4.25 would affirm the flag, with a measured transfer concentrating on $5.55. Quick-term help holds at $3.90, whereas invalidation lies beneath $3.80.

With SUI sustaining robust relative power amongst Layer-1s, any dip throughout the flag construction might entice contemporary shopping for curiosity.

Key Ranges

Flag Base Assist: $3.90

Breakout Zone: $4.25–$4.29

Targets: $5.00 (psychological) → $5.55 (measured transfer)

Invalidation: Beneath $3.80

If the sample confirms, SUI could also be establishing for its subsequent leg larger — positioning itself as a standout amongst L1 narratives.

BONK – Meme Coin Surge with Rounded Backside Construction

After months of accumulation, BONK has carved out a well-defined rounded backside, and worth is now consolidating inside Base 3, slightly below key resistance at $0.00003937.

A breakout above this degree might set the stage for a full extension towards $0.000059 — its December excessive and subsequent main promote zone.

Present help ranges are discovered at $0.00003169 and $0.00002780, whereas resistance ranges stay at $0.00003937 and $0.00004859. The technical construction exhibits every base forming at larger lows, suggesting robust accumulation and wholesome momentum.

Catalyst-wise, BONK continues to dominate Solana meme coin chatter throughout X and Discord. Quantity has expanded alongside worth — a powerful signal of conviction.

With the worth reclaiming all main EMAs and a visually intact parabolic curve in play, BONK is shaping as much as be greater than hype.

A clear breakout above Base 3 might set off a vertical rally towards $0.000059, giving merchants a high-R:R setup within the meme sector.

Hyperliquid (HYPE) – Flag Breakout and Rising OI Gasoline Bullish Setup

Hyperliquid’s native token HYPE is quietly constructing steam. With a 36% bounce in day by day mindshare and climbing open curiosity, the token is grabbing consideration from each merchants and whales.

On-Chain and Derivatives Energy

Open Curiosity (OI) in HYPE futures has constantly climbed since Might, now hovering above $2B, reflecting regular leveraged curiosity.

A wise whale was just lately noticed putting a 10x lengthy place on HYPE, including to bullish conviction.

HYPE additionally leads latest price technology throughout DEXs, indicating robust platform utilization and token utility.

Technical Image

HYPE seems to be forming a bullish flag sample inside a broader uptrend. The value just lately examined the $41–$42 help zone after a close to breakout to the all-time excessive (ATH) of $50.56.

Key ranges to observe: $44.00 (present), $50.56 (ATH), $37.15 (help)

Chart sample: Bull flag continuation

Indicators: RSI cooling off barely, MACD approaching bullish crossover

If HYPE maintains this consolidation and breaks previous $50, a next-leg surge towards $75 may very well be in play. Nevertheless, a failure to carry the $41–$42 vary could lead to a brief cooldown towards $37–$31.

TRON (TRX) – Rising Person Base Helps Breakout Setup

TRX is making a quiet however highly effective push each on-chain and on the charts. With a 42% improve in day by day mindshare, it’s rising as one of the vital essentially backed large-cap performs.

On-Chain Fundamentals

TRON now has over 188 million holders, per TRONSCAN, steadily climbing from underneath 140M a yr in the past.

Every day lively customers and stablecoin quantity stay among the many highest in crypto.

Technical Setup

TRX is shifting inside a clear ascending channel. The present construction exhibits worth bouncing from the decrease trendline and heading towards resistance close to $0.40. Past that, a transfer towards the December 2024 excessive round $0.45 might play out.

Present worth: $0.315

Channel help: $0.27–$0.29

Resistance ranges: $0.334 (mid-line), $0.40, $0.45

EMAs: 20/50/100/200 all help bullish momentum

This setup presents a measured transfer that would deliver TRX towards its prior highs if momentum holds.

Ethereum Title Service (ENS) – Cup and Deal with Breakout in Progress

ENS is near finishing a multi-month cup-and-handle formation, with the neckline forming at $30.15–$30.50. After a rounded base since March, worth is now coming into the deal with section — typically a precursor to breakout continuation.

Presently buying and selling at $26.75, ENS faces fast resistance on the neckline. A clear breakout above this degree might set off a rally towards $38.56, with prolonged targets at $45.52 and $50.75 into This autumn. Key helps lie at $24.13, $22.01, and $20.75.

Momentum indicators stay bullish — EMAs are stacked favorably, RSI is elevated, and MACD exhibits ongoing upside power. With rising curiosity in decentralized identification protocols, ENS is gaining traction as a essentially robust Web3 utility token within the present market rotation.

A breakout from the deal with might unlock 32–40% upside, confirming the construction and signaling renewed bullish continuation.

Toncoin (TON) – Telegram’s Pockets Push Triggers Breakout Momentum

Toncoin has been gaining main consideration following Telegram’s expanded rollout of its built-in TON Pockets to U.S. customers, a transfer that quietly went reside simply two days in the past. This isn’t simply one other app characteristic — it successfully onboards tens of hundreds of thousands of Telegram customers into Web3, with native help for staking, DeFi, and NFT apps immediately inside chat.

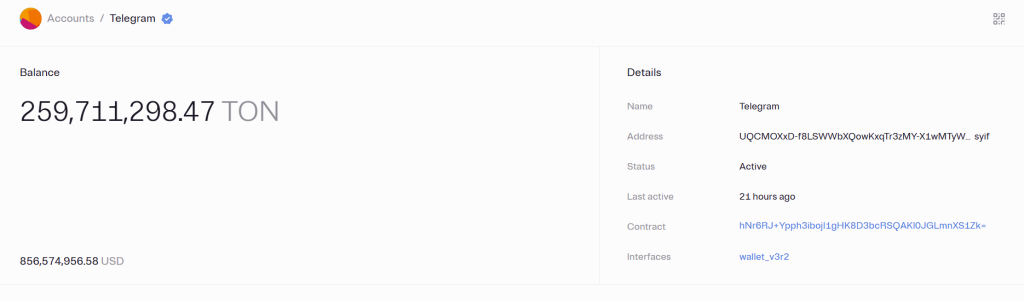

Telegram’s official company pockets on the TON blockchain at present holds over 259 million TON, valued at $856 million, with on-chain exercise seen simply 21 hours in the past — reinforcing its deep operational stake within the ecosystem.

As this characteristic began rolling out, TON surged to the highest of Messari’s 1-day mindshare leaderboard, clocking a staggering +858.67% spike in consumer consideration — pushed by rising social chatter, search curiosity, and influencer buzz throughout platforms.

TONUSD Technical Evaluation

Toncoin worth just lately confirmed a breakout from a well-formed falling wedge that had been compressing for over two months. The transfer was sharp and decisive, with worth rallying from $2.72 to $3.57 in just below 10 days, signalling a transparent shift in momentum.

This breakout was supported by a reclaim of the 20, 50, and 100 EMAs, highlighting renewed bullish power. TON is now dealing with key resistance on the 200 EMA close to $3.57, a degree that may possible decide the following leg of the pattern. Quick help rests at $3.16 and $3.06 — the previous resistance zone now appearing as a possible retest space.

If momentum continues, the following targets lie at $3.69, adopted by $4.20 and $4.90 — marking earlier native highs and macro resistance ranges.

Whereas the RSI has cooled to 67.8, suggesting a possible pause or short-term consolidation, the MACD tells a distinct story. The indicator flipped bullish on July 8 — proper because the breakout occurred — and the rising histogram continues to substantiate upward momentum.

Briefly, the technical setup factors to a powerful pattern shift, with room for additional upside if TON can flip the 200 EMA into help.