Product Obtainable right here:

https://www.mql5.com/en/market/product/145087/

Options

Three Hull MA Variations: Basic HMA, Exponential HMA (EHMA), and Triangular HMA (THMA) Multi-Timeframe Help: View larger timeframe Hull MA on any chart Dynamic Coloration Coding: Computerized trend-based coloration switching for simple visualization Candle Physique Coloring: Coloration candle our bodies primarily based on Hull pattern or worth place Actual-Time Alerts: Get notified on pattern modifications and candle coloration switches Customizable Visuals: Adjustable colours, line thickness, and transparency Band Show Choice: Present shifted Hull line for enhanced visible evaluation

Worth Coloring:

HMA Types:

Hull Transferring Common (HMA) The unique Hull MA system that reduces lag whereas sustaining smoothness. Excellent for pattern following and swing buying and selling setups.

Exponential Hull Transferring Common (EHMA) Makes use of exponential smoothing as a substitute of weighted averages, offering quicker response to cost modifications whereas retaining the Hull system advantages.

Triangular Hull Transferring Common (THMA) A singular variation that makes use of triangular weighting, providing the smoothest indicators with minimal false breakouts.

The way to Use

Pattern Identification: When the Hull line is inexperienced/lime, the pattern is bullish. When crimson, the pattern is bearish.

Entry Alerts: Search for coloration modifications from crimson to inexperienced for lengthy entries, and inexperienced to crimson for brief entries.

Use SR areas like from Pivots or Quarter Areas for entry and exit.

Multi-Timeframe Evaluation: Set a better timeframe (like H4 on M15 chart) to see the larger image pattern whereas buying and selling on decrease timeframes.

Candle Coloring: Allow candle physique coloring to immediately see if worth is above or under the Hull line, or following the Hull pattern course.

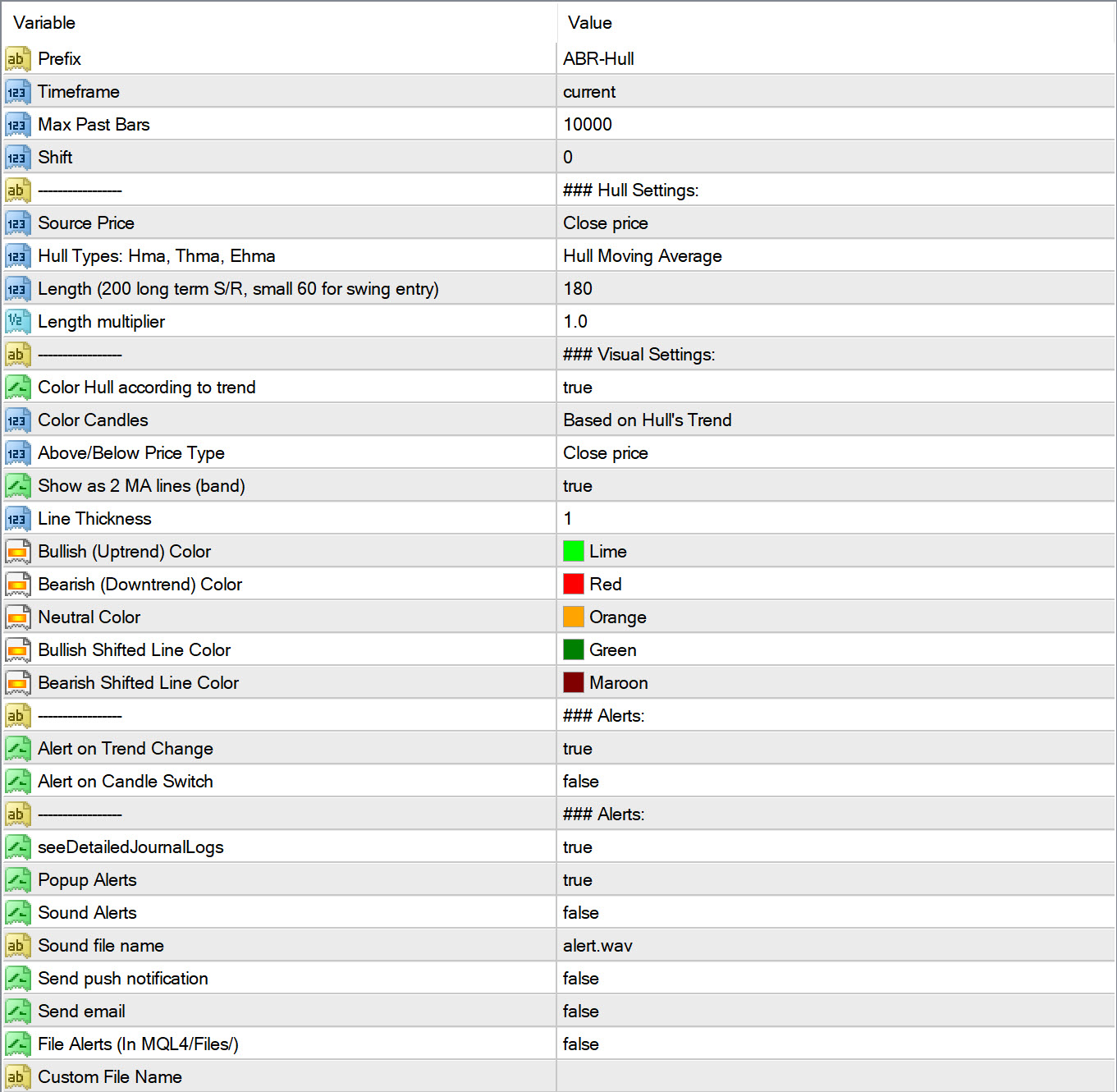

Settings:

Hull Settings

Supply Worth: Select which worth (Shut, Excessive, Low, and so on.) to calculate Hull MA from Hull Variation: Choose between HMA, THMA, or EHMA Size: Interval for Hull calculation (smaller like 55 for swing buying and selling, 180-200 for help/resistance) Size Multiplier: Multiply the bottom size for longer-term evaluation

Visible Settings

Coloration Hull: Allow/disable computerized coloration switching primarily based on pattern Coloration Candles: Select candle coloring mode (None, Pattern-based, Above/Beneath Hull) Present as Band: Show each foremost and shifted Hull traces for band evaluation Line Width: Regulate thickness of Hull traces Colours: Customise bullish, bearish, and impartial colours

Alert Settings

Alert on Pattern Change: Get notified when Hull pattern switches Alert on Candle Change: Get alerted when candle colours change

Instance Buying and selling Methods

Technique 1: Long run H1

Add Wyatt’s Pivots for Weekly if utilizing H1. Or Pivots-H4 if TF is M1. Pivot-Each day if TF is M5-M15.

Anticipate a excessive quantity candle from VolumeCandles to cross a Pivot degree.

Use default HMA 60 interval and three multiplier. And solely commerce if in course of Hull MA pattern.

Technique 2: M5 for fast scalping

Hull MA: Settings are Size is 60, and Size Multiplier is 3.

QQE Blue for Purchase and Crimson for SELL.

Quantity Oscillator: Above 0%

Waddah Attar Explosion above explosion line

Easy RSI: Not above Overbought(70) for Purchase. And Not under oversold (30) for SELL.