Key Takeaways:

U.S. authorities crypto holdings have fallen about $12 billion from Bitcoin’s peak, now close to $29.6 billionBitcoin dominates the portfolio, with over 328,000 BTC seized from legal instancesPockets actions are carefully tracked as a result of future gross sales may have an effect on market provide

The U.S. authorities stays one of many world’s largest identified Bitcoin holders, even after a pointy decline in portfolio worth. New on-chain knowledge reveals how market swings, not lively buying and selling, are driving the valuation of its crypto reserves.

Learn Extra: Holding $17.8B, US Authorities Now One of many Largest Crypto Whales

U.S. Authorities Crypto Holdings at a Look

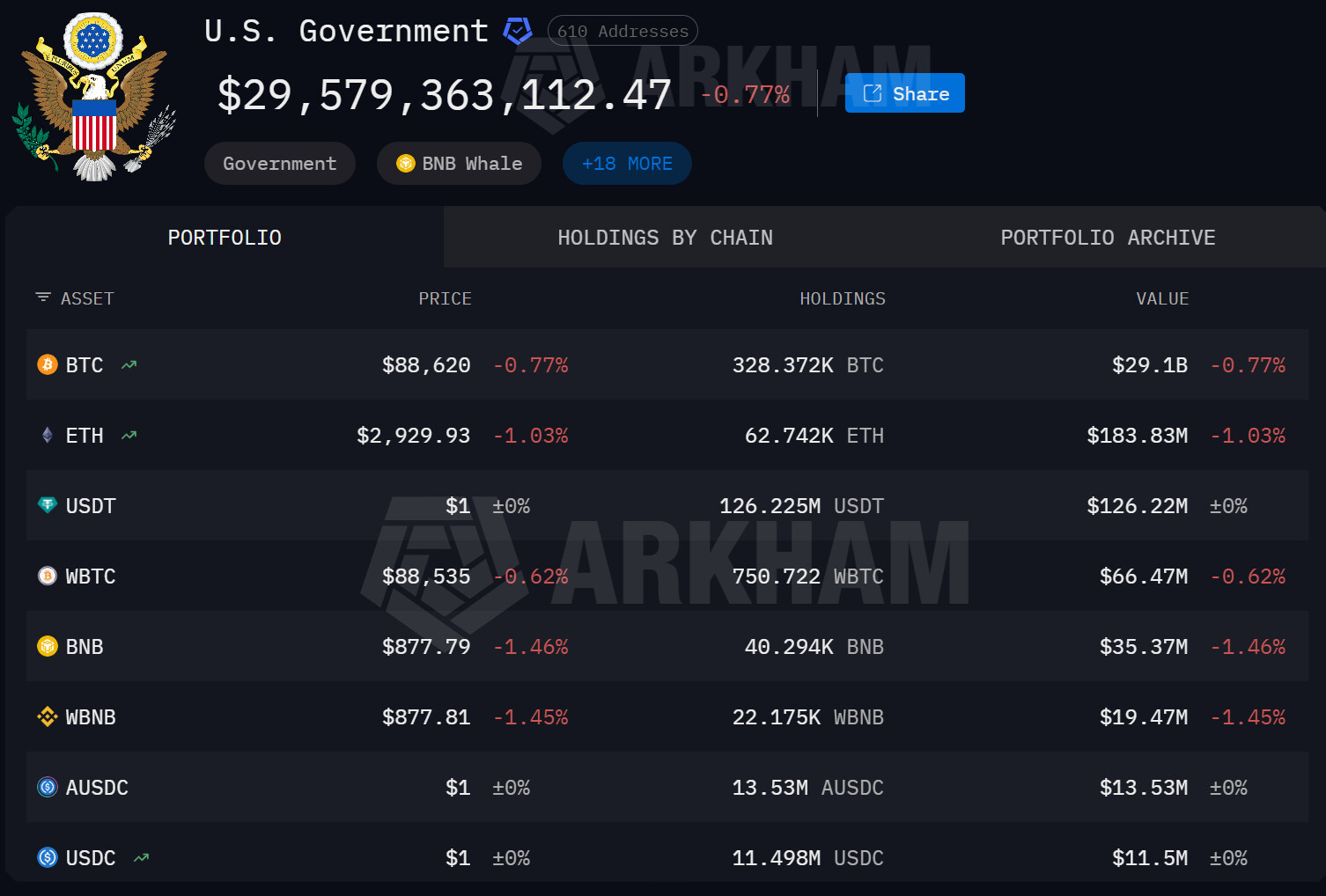

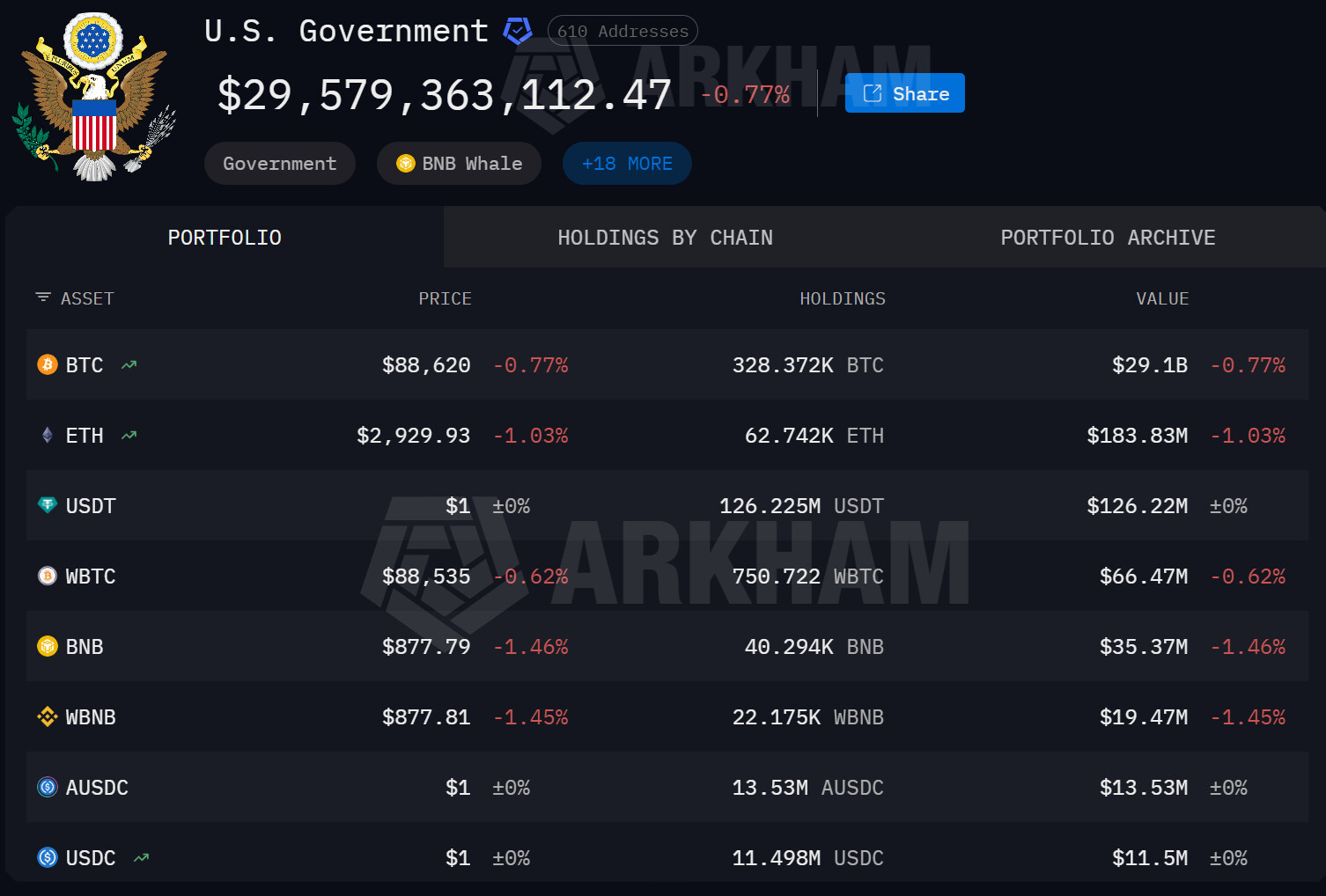

In keeping with blockchain analytics platform Arkham Intel, wallets linked to U.S. authorities companies at the moment maintain crypto belongings price roughly $29.6 billion. That determine is down about $12 billion from Bitcoin’s latest peak, reflecting the broader market pullback quite than any main disposals.

These holdings weren’t constructed from the buildup technique with clear objective. As a substitute, they arrive from years of seizures tied to legal investigations. The Division of Justice (DOJ), The Division of Justice (IRS), Inner Income Service, and different companies typically seize digital belongings referring to actions of darknet market, ransomware, frauds and large-size hack assaults.

Captured belongings have been transferred to Authorities-controlled wallets throughout authorized processing. The on-chain public visibility of those wallets reveals that they’re being carefully monitored by analysts and merchants.

Breakdown of Seized Belongings

The overwhelming majority of the portfolio is Bitcoin. Estimates by the federal government point out that it possesses:

328,370 BTC62,740 ETH125.7 million USDT

Bitcoin constitutes each of the portfolio worth at current and virtually all of the portfolio volatility. Balances of Ethereum and stablecoins are smaller and this-indicates that instances of particular person seizure are seen and a diversification technique shouldn’t be developed.

How These Belongings Enter Authorities Wallets

Cryptocurrency comes underneath the Federal Authorities on account of regulation enforcement. Coverage has conventionally been in assist of liquidation after forfeiture is accepted by courts. Belongings are auctioned and transformed in U.S. {dollars} and sufferer compensation or transferred to Treasury or DOJ funds.

The technique has established important provide occasions up to now, notably when there’s a huge Bitcoin public sale. A person sale generates promote facet pressures although not in real-time.

Market Consideration and Coverage Hypothesis

The drawn down has raised the controversy on whether or not the federal government ought to proceed with its liquidation of the seized Bitcoin or to deal with it otherwise. Different observers available in the market speculate that the present and subsequent administrations would possibly put a halt to gross sales, and inventory Bitcoin as a reserve for use in the long run.

As of but, a coverage change has been refuted formally. Nonetheless, even the dimensions of the holdings makes the topic troublesome to miss. Even a transfer to promote, preserve or switch part of BTC can have an effect on market sentiments.

Learn Extra: El Salvador Provides $101M in Bitcoin as Authorities Buys 1,098 BTC Throughout Market Dip