The USD/JPY weekly forecast signifies additional weak spot within the US labor market.

The US economic system added solely 22,000 jobs in August.

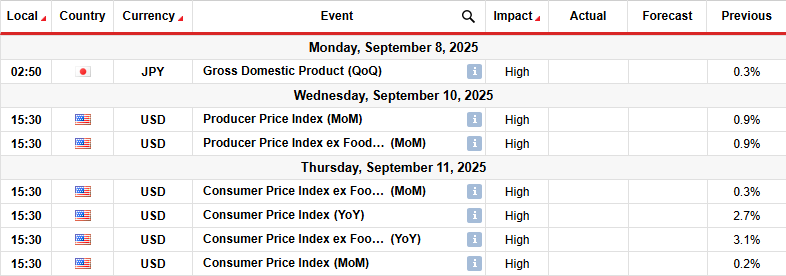

Subsequent week, the US will launch its client and wholesale inflation reviews.

The USD/JPY weekly forecast signifies additional weak spot within the US labor market, which helps a extra dovish Fed.

Ups and downs of USD/JPY

USD/JPY ended the week bullish however closed effectively beneath its highs because the greenback dropped. In the beginning of the week, the greenback recovered briefly in opposition to the yen as merchants awaited essential US employment figures. Nevertheless, as the info got here in, it turned clear that the labor market had softened greater than anticipated.

–Are you to be taught extra about MT5 brokers? Test our detailed guide-

Nonfarm payrolls revealed that the US economic system added solely 22,000 jobs in August, in comparison with the forecast of 75,000. In the meantime, the unemployment fee rose to 4.3% as anticipated. The poor figures elevated expectations for Fed fee cuts, weighing on the greenback.

Subsequent week’s key occasions for USD/JPY

Subsequent week, the US will launch its client and wholesale inflation reviews, which is able to form the outlook for Fed fee cuts. Already, market individuals are absolutely pricing a fee minimize in September. Nevertheless, the outlook for future fee cuts continues to be altering. Furthermore, there’s a probability the Fed will decide to ship a large fee minimize this month.

If client inflation is available in beneath estimates, fee minimize expectations will enhance, and the greenback will lengthen its decline. However, a constructive determine may ease fee minimize bets.

USD/JPY weekly technical forecast: Bears put together to problem the channel help

On the technical facet, the USD/JPY worth trades in a bullish channel with clear help and resistance traces. Nevertheless, the worth can also be chopping by way of the 22-SMA, an indication that bears are displaying energy. This additionally signifies that the transfer is corrective.

–Are you to be taught extra about Thailand foreign exchange brokers? Test our detailed guide-

Beforehand, the USD/JPY was buying and selling in a well-developed downtrend, principally staying beneath the 22-SMA. Nevertheless, the decline paused when it reached the 140.01 key help degree. Right here, bulls took cost, making increased highs and lows. Nevertheless, the brand new pattern was shallow and corrective.

Inside the bullish channel, the worth has damaged beneath the SMA, and the RSI has dipped beneath 50. Subsequently, bears are at present stronger and will quickly problem the channel help. On condition that the worth is at present in a corrective transfer, a breakout would probably result in an impulsive transfer. If bears escape of the channel, the worth will fall to retest the 140.01 help degree.

Seeking to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must contemplate whether or not you’ll be able to afford to take the excessive threat of dropping your cash.