The USD/JPY weekly forecast factors to cautious tones from Powell and Ueda.

The yen gained after Prime Minister Ishiba mentioned he would keep on.

A shock commerce deal between Japan and the US boosted the yen.

The USD/JPY weekly forecast factors to cautious tones throughout subsequent week’s Fed and Financial institution of Japan coverage conferences.

Ups and downs of USD/JPY

The USD/JPY worth ended the week purple however far above its lows. The worth fluctuated all through the week as merchants centered on elections, tariffs, and financial information. The ruling occasion in Japan misplaced its majority within the higher home. Nevertheless, the yen gained after Prime Minister Ishiba mentioned he would keep on.

-Are you searching for the perfect CFD dealer? Test our detailed guide-

In the meantime, a shock commerce deal between Japan and the US additional boosted the yen. It lowered Japan’s reciprocal tariff from 25% to fifteen%. Nevertheless, the pair reversed its decline after unemployment claims information revealed resilience within the US labor market, pushing the greenback greater.

Subsequent week’s key occasions for USD/JPY

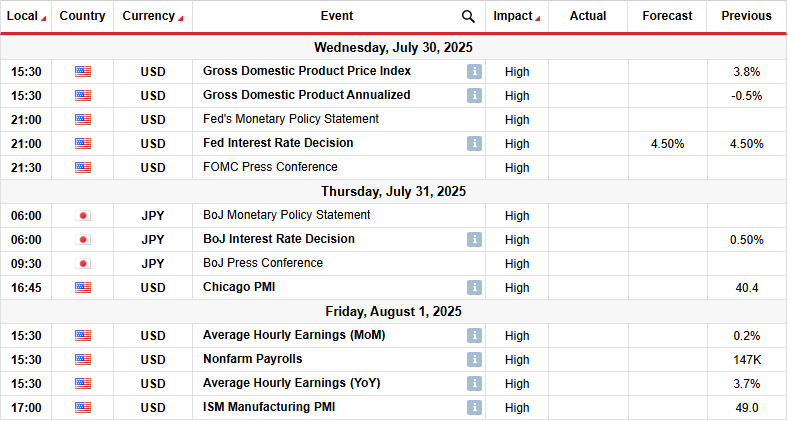

Subsequent week, the US will launch its GDP report, enterprise exercise information, and the nonfarm payrolls. On the identical time, merchants will give attention to the FOMC coverage assembly for clues on the following charge minimize. In the meantime, the Financial institution of Japan can also be set to fulfill on Thursday.

Each the Fed and the BoJ are prone to preserve delaying their subsequent strikes because of the affect of Trump’s tariffs. Subsequently, Powell may stay cautious about charge cuts whereas Ueda will stay cautious about charge hikes.

USD/JPY weekly technical forecast: Bulls retarget the 149.01 resistance degree

On the technical facet, the USD/JPY worth is bouncing in direction of the 149.01 resistance after retesting the 22-SMA assist line. The worth has been in a corrective transfer between a key assist trendline and the 149.01 key resistance degree. Inside this space, the worth has chopped by way of the SMA, an indication that bears and bulls are virtually equally matched.

-In case you are taken with assured stop-loss foreign exchange brokers, examine our detailed guide-

The corrective transfer got here after a downtrend that paused on the 140.01 assist degree. Subsequently, it’d solely be a pause as bears regain momentum. If so, the worth will doubtless quickly break beneath the assist trendline. To retest the 140.01 assist. Such a transfer would additionally enable the earlier downtrend to proceed.

Then again, if bulls are able to take cost, the worth will break above the 149.01 key resistance degree. This could enable USD/JPY to retest the 154.02 resistance degree.

Trying to commerce foreign exchange now? Make investments at eToro!

68% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You must think about whether or not you’ll be able to afford to take the excessive danger of shedding your cash.