Crypto futures are spinoff contracts that allow you to take a position on the long run worth actions of cryptocurrencies. They enable you to achieve publicity to the crypto market with out really buying, proudly owning, or transacting the underlying belongings.

On this article, we’ll supply helpful insights into cryptocurrency futures contracts, their working, sorts, options, advantages, and dangers. We’ll additionally present a step-by-step information to buying and selling futures, protecting key methods and high cryptocurrencies for contract buying and selling.

What Are Cryptocurrency Futures?

Crypto futures are agreements between two merchants to purchase or promote the underlying cryptocurrencies at particular costs by sure dates. They’re settled in fiat, stablecoins, or the underlying digital foreign money.

In essence, cryptocurrency futures are much like conventional futures contracts. They require each consumers and sellers to fulfil their obligations at predetermined costs by or earlier than a contract’s expiration date.

How Does Crypto Futures Work?

When merchants purchase a futures contract, they open an extended place. Conversely, after they promote, they open a brief place.

Nonetheless, earlier than partaking in futures buying and selling, merchants have to fulfil margin necessities. Exchanges gather two forms of margins: preliminary and upkeep margins. Preliminary margin is the minimal collateral required to open a futures place. Upkeep margin is the minimal fund stability merchants ought to preserve of their margin accounts to maintain their positions open.

If a cryptocurrency’s worth drops drastically resulting from hostile worth actions, the collateral could also be unable to cowl the place. In such situations, a margin name is triggered, informing merchants to replenish their margin accounts. For those who fail to answer a margin name, your place can be liquidated.

3 Methods to Shut a Futures Contract

Offsetting: Offsetting a futures place is the easiest way to liquidate a contract. It additionally helps merchants keep away from bodily supply of the underlying belongings. It’s good to execute equal and reverse transactions to offset a place. For instance, think about to procure two Bitcoin futures contracts expiring in September. To neutralize this commerce, you should promote two Bitcoin futures that additionally expire in September.

Rolling over: You possibly can roll over a cryptocurrency futures contract if you wish to preserve your publicity to the dynamic market. As an example, assume you’ve gone lengthy on two Ether futures contracts that expire in October. You possibly can roll over this place by promoting two October contracts and shopping for two December contracts.

Settling the contract: A futures contract is settled solely when each events fulfil their obligations by the expiry date. Merchants holding lengthy and quick positions should purchase or promote the underlying cryptocurrency as per the contract phrases.

Sorts of Crypto Futures Contracts

Perpetual futures: They’re linear contracts with no expiry date. Therefore, merchants can maintain them indefinitely.

Expiry futures: They’re linear contracts with a hard and fast expiry date, after which they stop to exist.

Inverse futures: They’re non-linear contracts which can be quoted in fiat however settled within the underlying cryptocurrency.

Key Options of Crypto Futures Contracts

Zero-sum recreation

Since one dealer should incur losses for the opposite dealer to make features, crypto futures buying and selling is a zero-sum recreation.

Expiration date

It’s the date on which a futures contract ceases to exist. Additionally it is referred to as the strike or train date. Each events agree upon the expiration date on the time of getting into into the contract.

Train worth

It’s the worth at which the futures contract can be executed. Additionally it is referred to as the strike worth, and is fastened on the time of formation of the contract.

Contract dimension

It signifies the amount of the underlying asset a derivatives contract represents. A contract could be priced by way of the underlying digital foreign money or asset. For instance, 1 contract = $2,50,000 price of Ether or 1 contract = 50 Ether.

You can too do fractional buying and selling of crypto futures. Thus, you should buy or promote contracts with sizes as little as 0.0001 BTC.

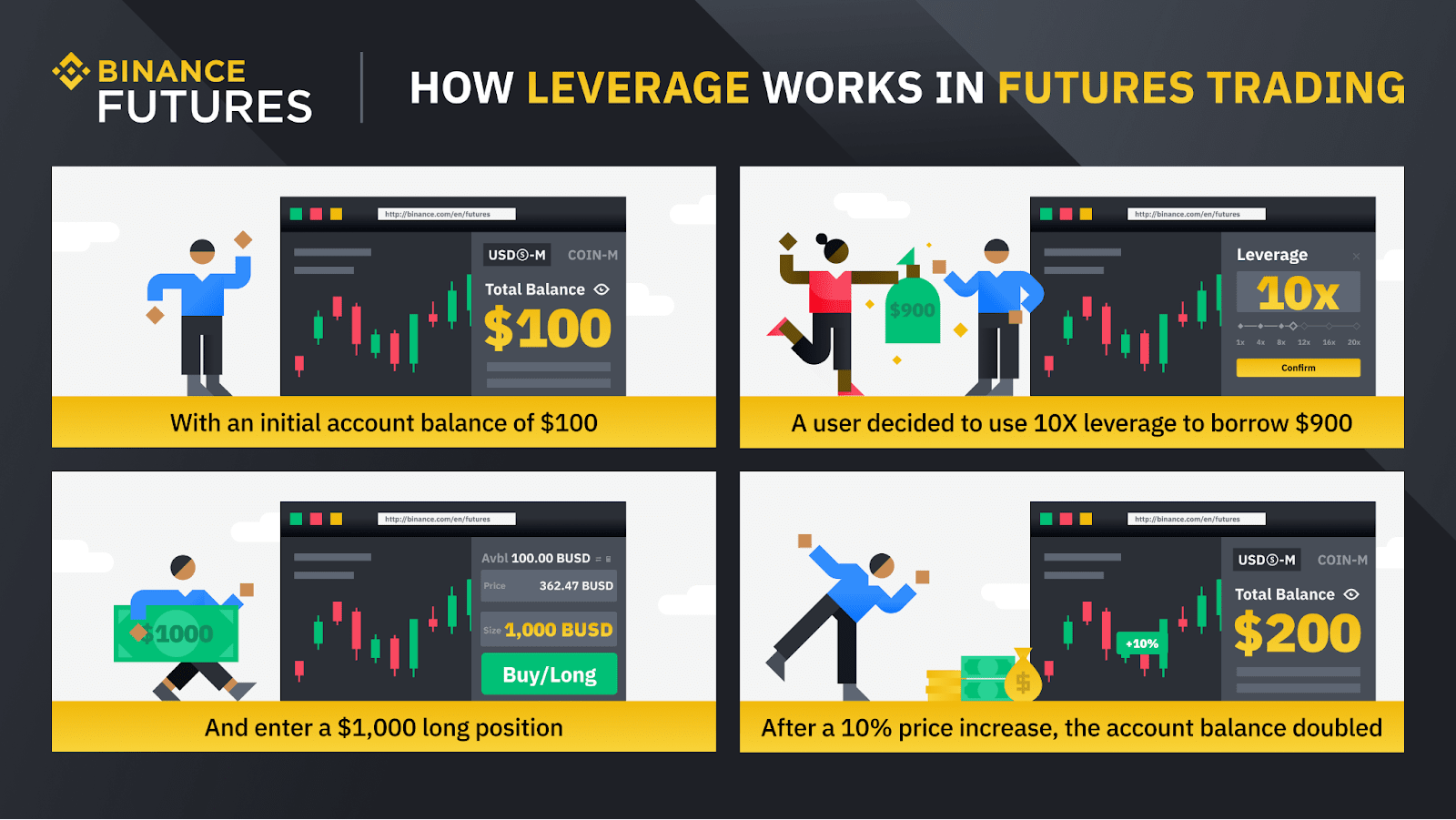

Leverage

Most exchanges allow merchants to make use of leverage to manage giant positions with smaller quantities of capital upfront. As an example, a 10x leverage means you should deposit only one/10th of the long run contract’s notional worth as margin. Thus, if the notional worth is $550,000, you should fulfil a margin requirement of $55,000.

The settlement technique additionally varies throughout futures exchanges and merchandise. For instance, Binance affords USD-margined contracts which can be settled in United States Greenback Coin (USDC) and Tether (USDT). It additionally affords coin-margined contracts which can be settled within the underlying cryptocurrencies. For each merchandise, merchants should deposit their precise cryptocurrency holdings as collateral.

Contrarily, CME Group facilitates the money settlement of crypto futures. It means merchants should settle the contracts in a fiat foreign money like USD.

Tick

Each futures contract comes with a minimal worth fluctuation, often known as a tick. As an example, the minimal tick dimension of CME Bitcoin futures is $5, whereas its contract dimension is 5 BTC. Due to this fact, the worth of a tick transfer equals $25 ($5 X 5).

Crypto Futures vs Crypto Choices: What’s the distinction?

Cryptocurrency futures

Cryptocurrency Choices

A crypto futures contract is an obligation to purchase or promote the underlying cryptocurrency at a predetermined worth on a future date.

A crypto choices contract provides consumers the fitting, not the duty, to buy or promote the underlying digital foreign money.

Futures contracts are settled in money (fiat foreign money), stablecoins, or cryptocurrencies.

Most exchanges supply crypto choices settled in stablecoins, particularly USDT and USDC.

Crypto futures can be found on a number of cryptocurrencies.

Crypto choices are supplied solely on a restricted variety of cryptocurrencies, significantly Bitcoin and Ether.

Losses could be limitless, particularly when traded utilizing leverage.

For consumers, losses are restricted to the choice premium paid. For sellers, losses could be limitless relying on market volatility.

Finest Cryptocurrencies for Futures Buying and selling

Bitcoin futures

Bitcoin (BTC) is the biggest cryptocurrency by market capitalization (cap) and has the best greenback worth per coin. With Bitcoin futures, you may get publicity to the Bitcoin market with out really proudly owning BTC. Furthermore, Bitcoin futures are probably the most liquid and actively traded.

Ether futures

Ether (ETH) is the second-largest cryptocurrency by market cap. It’s the prime governance token of Ethereum, the pioneer blockchain that helps good contracts and decentralized functions. By way of Ether futures, you possibly can garner income from ETH’s worth actions in both path.

Solana futures

SOL is the native token of the Solana blockchain. It’s an ultra-fast, extremely scalable, and energy-efficient community, making it a sizzling alternative for upcoming Web3 initiatives. Thus, SOL carries a robust progress potential, and Solana futures give you a strong strategy to faucet into it.

XRP futures

XRP is the utility token of the XRP ledger, an open-source community that fosters cost-efficient cross-border funds. Additionally it is the third-largest crypto as per market cap. With XRP futures, you possibly can achieve publicity to this promising market.

Learn how to Commerce Crypto Futures

Step 1: Register on an trade

To commerce futures, you should create your account on a crypto trade utilizing your e mail or telephone quantity. If you have already got an account, go surfing to the trade.

Step 2: Open a futures buying and selling account

Exchanges like Binance require merchants to open a separate futures account. To activate this account, you should full just a few duties on the platform.

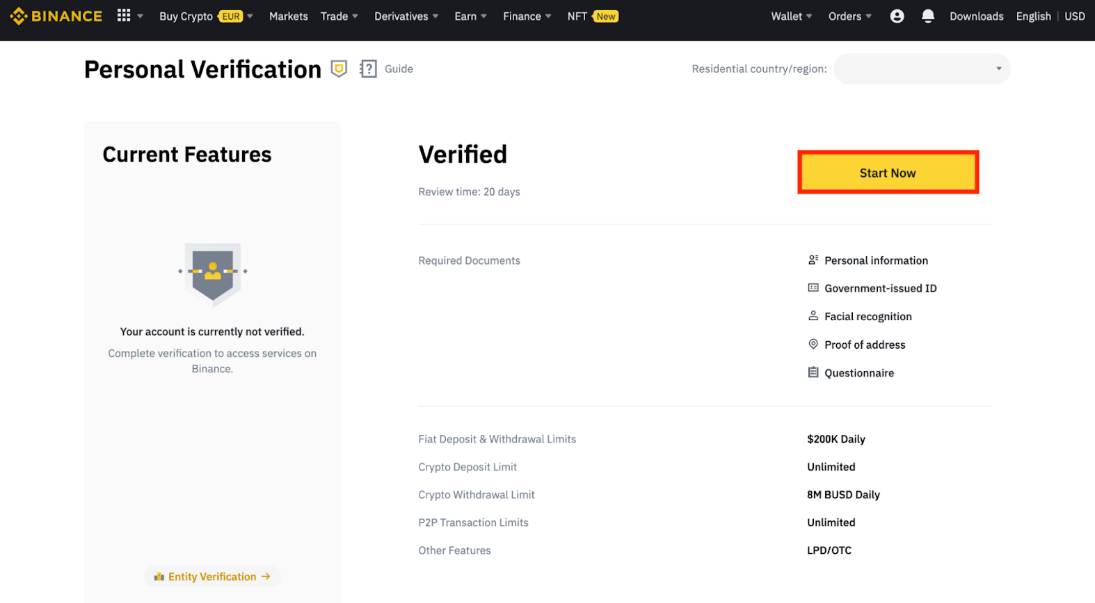

Step 3: Full id verification

Earlier than you start contract buying and selling, you should full the know-your-customer (KYC) course of. Enter primary particulars resembling identify, location, and many others., and go a facial recognition take a look at. Moreover, submit a government-authorized id proof and a sound tackle proof.

Step 4: Make the primary deposit

As soon as your account is verified, deposit fiat or cryptocurrencies into your trade pockets. Often, exchanges help numerous cost strategies like financial institution switch, credit score/debit card, PayPal,… to assist merchants make deposits. As soon as finished, you’re able to open a futures place.

Buying and selling on Regulated vs. Unregulated Exchanges

Regulated exchanges function below the oversight of presidency authorities. For instance, the CME Group is regulated by the Commodities Futures Buying and selling Fee (CFTC).

These authorities businesses additionally decide the quantity of leverage a dealer can use. Furthermore, margin necessities are greater on exchanges working in a regulated atmosphere. Thus, they assist curtail the magnitude of losses suffered by merchants resulting from hostile worth actions. Moreover, exchanges just like the CME Group use reference charges to make sure honest pricing.

Conversely, unregulated exchanges enable merchants to imagine extreme dangers. Some platforms supply leverage of as much as 500x on sure futures pairs. The upper the leverage, the upper the chance of incurring vital losses. Moreover, no authorized recourse is on the market if you happen to lose your belongings on unregulated exchanges.

What’s Chicago Mercantile Alternate (CME)?

CME is one of the best regulated trade for buying and selling cryptocurrency futures on XRP, Solana, Bitcoin, and Ether. It kinds a part of the CME group, the world’s hottest derivatives market.

Aside from crypto market insights, CME Group publishes benchmark reference charges and stay spot worth indices for numerous cryptocurrencies. Moreover, CME is the go-to platform for merchants looking for micro Bitcoin futures and progressive merchandise like Bitcoin Friday Futures.

Futures Merchandise

Contract Dimension

Minimal worth fluctuation per contract

Margin requirement

Bitcoin futures

5 Bitcoin

$25

50%

Micro Bitcoin futures

0.1 Bitcoin

$0.5

50%

Bitcoin Friday Futures

0.02 Bitcoin

$0.1

50%

Spot-quoted Bitcoin futures

0.01 Bitcoin

$0.1

50%

Ether futures

50 Ether

$25

60%

Micro Ether futures

0.1 Ether

$0.05

60%

Spot-quoted Ether futures

0.2 Ether

$0.1

50%

Solana futures

500 SOL

$25

50%

Micro Solana futures

25 SOL

$1.25

50%

XRP futures

50,000 XRP

$25

50%

Micro XRP futures

2,500 XRP

$1.25

50%

Advantages and Dangers of Crypto Futures Buying and selling

Advantages

Hedging: It’s a danger administration technique that serves as a security internet for crypto portfolios, particularly throughout excessive market volatility. As crypto futures are highly effective hedging instruments, they enable you to handle the chance of losses attributable to sudden worth swings. Merchants can safeguard lengthy positions within the spot market by going quick within the futures market, and vice versa.

Hypothesis: Cryptocurrency futures assist merchants speculate on future costs of underlying digital currencies. Often, merchants go lengthy on futures contracts when the cryptocurrency market rallies and go quick when the market slumps.

No cryptoasset possession: If managing crypto wallets or buying cryptocurrencies baffles you, futures buying and selling could be your finest wager. It lets you achieve publicity to cryptoasset costs with out proudly owning the belongings.

Decrease charges: The futures buying and selling charge is often decrease than spot buying and selling expenses on most exchanges.

Arbitrage: Crypto futures are perfect for merchants who want to reap the benefits of worth discrepancies throughout a number of buying and selling platforms. Nonetheless, the futures contracts on each platforms ought to have the identical settlement date, underlying cryptocurrency, leverage, and worth monitoring technique. Cryptocurrency futures additionally enable you to garner income from the value variations between the underlying asset’s spot and futures markets. Sometimes, you can also make features from arbitrage alternatives by assuming reverse positions within the two markets or platforms.

Excessive liquidity: Many crypto futures contracts are extremely liquid, which means merchants can enter and exit positions rapidly.

Dangers

Leverage: Many exchanges facilitate leveraged buying and selling of crypto futures contracts. They permit merchants to manage giant positions with out investing vital quantities of capital. Nonetheless, leverage is a double-edged sword. Whereas it magnifies potential features, it additionally amplifies potential losses.

Excessive margins: Some exchanges impose greater upkeep margins that represent a big proportion of a contract’s notional worth. Thus, merchants could also be compelled to regulate their place sizing or liquidate their trades.

Excessive volatility: Each cryptocurrencies and futures contracts are extremely risky. They’re usually topic to hostile worth actions, inflicting vital losses for merchants.

Well-liked Crypto Futures Exchanges

Coinbase: is a high US-based trade for cryptocurrency futures buying and selling. It affords CFTC-compliant perpetual contracts and nano futures on numerous cryptocurrencies, together with Bitcoin and Ether. The trade additionally supplies leverage of as much as 10x for futures buying and selling.

Binance Futures: is the largest trade by buying and selling volumes. In July 2025, its futures quantity touched $2.55 trillion, and its open curiosity reached a whopping $88 billion.

Dydx: is one of the best decentralized trade for buying and selling crypto perpetuals. It has recorded $220 million in open curiosity and affords as much as 50x leverage for futures buying and selling.

Crypto Futures Buying and selling Methods

Going lengthy: You need to go lengthy when the underlying asset’s worth is rising. This technique helps you procure the asset at a lower cost.

Going quick: You need to go quick when the underlying cryptocurrency’s worth is falling. This technique helps you promote the asset at a better worth and purchase it again later at a lower cost.

Scalping: It’s a quick-fire technique, the place merchants execute a number of small trades all through the day to revenue from minor worth fluctuations. It yields excessive returns throughout intense worth volatility in extremely liquid cryptocurrency markets.

Day buying and selling: It’s a appropriate technique for each skilled and new merchants who wish to keep away from in a single day worth fluctuations. It entails opening and shutting positions on the identical day.

Breakout buying and selling: During times of excessive volatility and fast modifications in market sentiment, breakout buying and selling is useful. It helps you clock income when costs break pivotal help and resistance ranges.

Conclusion

Cryptocurrency futures assist merchants probably revenue from hypothesis and arbitrage alternatives. Furthermore, the value volatilities of cryptocurrencies rely upon a number of components, together with market sentiment, macroeconomic traits, and regulatory developments. Understanding these dynamics and utilizing danger administration methods like hedging is crucial to revenue from futures buying and selling.

FAQs

Are you able to make $100 a day with crypto?

You can also make $100 a day via spot buying and selling of crypto. Nonetheless, it relies on numerous components like your accessible capital, danger tolerance, and buying and selling technique. Making $100 a day is simpler with cryptocurrency futures, as many exchanges facilitate leveraged buying and selling of derivatives.

Is crypto futures buying and selling worthwhile?

Crypto futures allow you to make income by speculating on a cryptocurrency’s future costs or via arbitrage alternatives. Moreover, you should use leverage to commerce futures contracts and enhance your features.

Can I commerce futures with $100?

With $100, you possibly can commerce futures on low-priced cash. You can too commerce micro futures on well-liked cryptocurrencies. Furthermore, many platforms supply over 100x leverage on choose pairs. Due to this fact, you possibly can open a $10,000 place with a margin of simply $100.

What’s the distinction between customary and micro futures?

Standardized futures are full-size contracts that enable merchants to take giant positions within the futures market.

Conversely, micro futures are byte-sized contracts that are perfect for merchants with low danger tolerance and who wish to take small positions.

For instance, the dimensions of CME Group’s standardized Bitcoin futures contract is 5 BTC. Their micro Bitcoin futures contracts are sized at 0.1 BTC.

The put up What’s Crypto Futures Buying and selling and How Does It Work? appeared first on NFT Night.