Right here’s an fascinating truth: Most individuals don’t lose their crypto to hackers, however to dangerous custody decisions. You purchase Bitcoin, retailer it someplace, and assume it’s secure—however that security could be fragile. This information explains what self-custody is in crypto, how a crypto pockets actually works, what occurs to your personal keys, and the way these components form safety, freedom, and threat within the crypto ecosystem.

What Is Self-Custody in Crypto?

Self-custody means you management your crypto, not an organization, a pockets app, or another platform. Whenever you use self-custody, you’re the one holding your personal keys, which provides you direct entry to your digital belongings on the blockchain. There are not any middlemen who management something “for you”, and no exterior approvals wanted to do what you need together with your cash. Nobody can freeze or transfer your funds with out your consent.

With self-custody, you maintain all of the keys—and all of the accountability. That management comes with freedom, but additionally threat. In the event you lose entry to your keys, no person can restore them. However for those who defend them nicely, no person can take your funds. It’s the place the favored saying comes from: “Not your keys, not your cash.”Self-custody is deeply rooted in crypto, which was designed to take away the reliance on banks and different conventional monetary establishments. Bitcoin launched in 2009 as a response to the 2008 monetary disaster, when belief in centralized techniques collapsed. Its core thought was easy: give individuals direct possession of cash with out intermediaries. To at the present time, this stays the core objective of self-custody.

Key Ideas in Self-Custody

Earlier than you need to use self-custody safely, that you must perceive its important constructing blocks. These ideas clarify how management, entry, and possession work in crypto.

Non-public keys.A personal key’s a secret quantity that proves possession of your digital belongings. Whoever controls it controls the funds. There is no such thing as a approval step and no assist for those who attempt to recuperate what you’ve misplaced.

Public keys and addresses.A public key’s created out of your personal key. It generates your pockets tackle, which others use to ship you crypto. Do not forget that sharing that is secure. It doesn’t give spending entry.

Transactions.A transaction occurs when your crypto pockets makes use of its personal key to signal a switch. The community verifies that signature and data it completely. As soon as confirmed, it can’t be reversed.

Seed phrase.A seed phrase is a human-readable backup of your personal keys, often 12 or 24 phrases. Anybody with it may well entry your funds. Lose it, and restoration turns into unimaginable.

Management and responsibilitySelf-custody offers you full management. There are not any intermediaries, but additionally no security internet. Safety turns into your sole accountability, not any firm’s.

How Self-Custody Works (Non-public Keys and Seed Phrases)

Self-custody works by supplying you with full management over your personal keys, which implies solely you may entry and transfer your crypto. Let’s check out every step of that course of in additional element.

A personal key’s created.Your crypto pockets generates a non-public key. This can be a lengthy, random quantity that proves possession of your crypto. Whoever controls it controls the funds.

A public key and tackle are derived.The personal key creates a public key, which then generates your crypto pockets tackle. This tackle is secure to share. It lets others ship you crypto, nevertheless it can’t spend something.

Your pockets shops and makes use of the important thing.The pockets holds your personal key and makes use of it to signal transactions. The important thing by no means leaves the pockets. It merely proves that you just licensed the motion.

A seed phrase backs all the pieces up.The pockets additionally creates a seed phrase, often 12 or 24 phrases. This phrase can recreate all of your personal keys. In case your machine breaks or disappears, the seed phrase restores entry.

Transactions are signed and despatched.Whenever you ship crypto, the pockets indicators the transaction regionally utilizing your personal key. The community checks the signature together with your public key, and data it completely.

There is no such thing as a undo button.As soon as confirmed, the transaction can’t be reversed or appealed. Due to this, in case your seed phrase is misplaced or uncovered, your funds are pretty much as good as gone.

Tips on how to Get Free Crypto

Easy tips to construct a worthwhile portfolio at zero value

Self-Custody vs. Custodial

With self-custody, you handle your crypto instantly. With custodial pockets companies, a 3rd occasion does it for you. That one alternative adjustments how entry, threat, and possession work.

Learn extra: Custodial vs. Non-Custodial Wallets

Professionals and Cons of Self-Custody

Self-custody offers you actual possession, nevertheless it additionally means you’re the one chargeable for all the pieces. That tradeoff issues, and it’s best to perceive it earlier than committing funds.

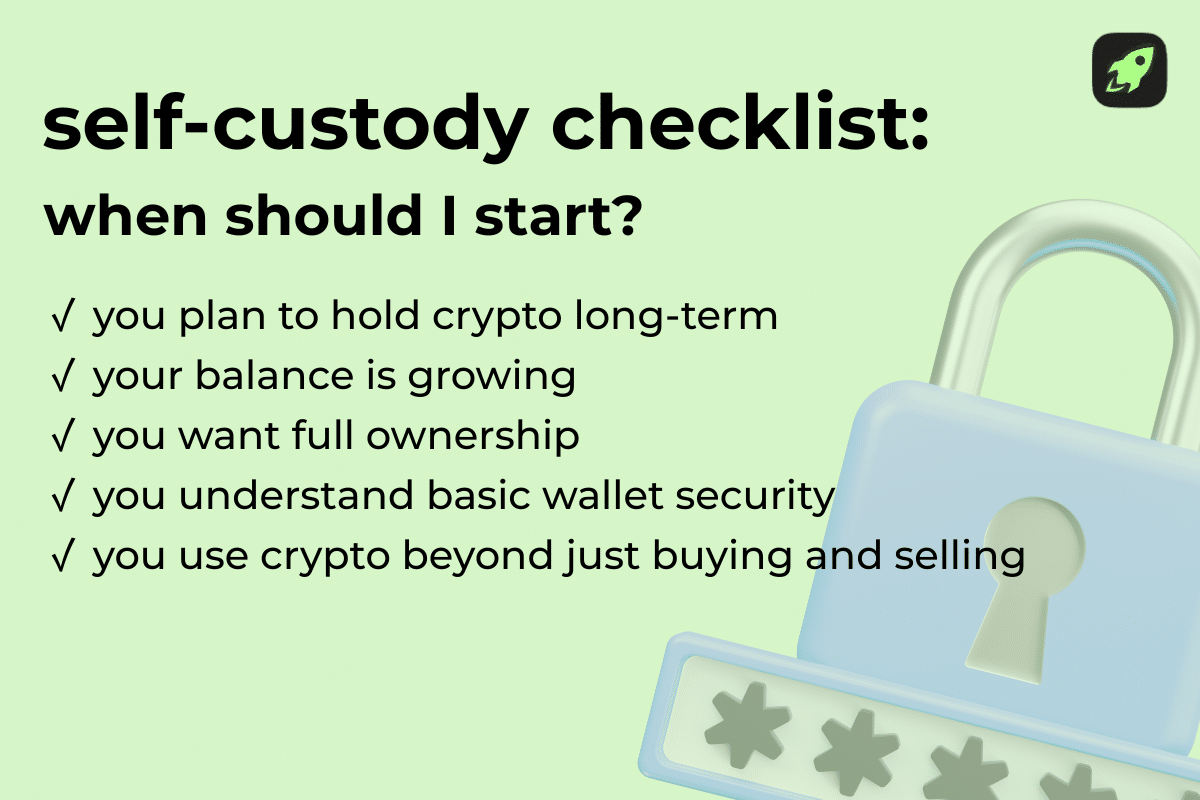

When Ought to I Begin Utilizing Self-Custody?

You must begin utilizing self-custody once you need actual possession of your crypto and are able to take accountability for it. There is no such thing as a one excellent second. The correct time will depend on how a lot you maintain, how usually you transact, and the way comfy you’re managing safety your self. Listed below are some widespread “tells” that it’s time to consider utilizing self-custody.

You maintain crypto long-term.In the event you plan to maintain Bitcoin or different belongings for months or years, self-custody reduces publicity to change failures and account freezes.

You’ve moved previous small experiments.As soon as your steadiness grows past what you’re comfy dropping, counting on a 3rd occasion turns into dangerous.

You need actual possession.Self-custody offers you direct entry to your belongings with out permission from a platform or service supplier.

You perceive fundamental pockets safety.If you understand how to retailer a seed phrase and defend your machine, you’re able to handle your individual setup.

You utilize crypto past shopping for and promoting.In the event you work together with decentralized apps, transfer funds between networks, or handle a number of belongings, self-custody turns into crucial.

Is a Self-Custody Pockets Protected?

It’s secure for those who use it appropriately. That security comes from eradicating any third events that might achieve entry to your funds. Self-custody removes publicity to change hacks, frozen accounts, and platform failures. No firm can lock you out or transfer your funds. That already removes a serious supply of loss in crypto historical past.

As a substitute, the danger shifts to the way you handle safety. Malware, phishing, and careless backups can nonetheless do harm. In case your machine is compromised or your restoration phrase leaks, funds can disappear quick. There is no such thing as a assist desk to reverse errors, and all of the accountability is on you.

A powerful setup provides further layers of safety to assist with this. Many individuals use a {hardware} pockets for long-term storage and preserve solely small quantities in a software program pockets for every day use. This provides distance between attackers and your belongings.

What Errors Ought to I Keep away from with Self-Custody?

Most losses in self-custody don’t come from hackers. They arrive from easy errors. Avoiding these widespread errors can defend you from everlasting loss.

Storing your seed phrase digitally.Screenshots, cloud notes, emails, or password managers are dangerous. In case your machine will get compromised, your funds can vanish.

Shedding your backup.In the event you lose your seed phrase and your machine fails, recovering your belongings turns into unimaginable. At all times preserve a safe bodily backup.

Conserving all the pieces in a single place.Storing your pockets and backup collectively creates a single level of failure. Separate them bodily.

Skipping take a look at transactions.At all times ship a small quantity first. One incorrect tackle or community can value you all the pieces.

Trusting random hyperlinks or messages.Phishing assaults usually look extremely life like. By no means enter your restoration phrase wherever besides inside your pockets throughout setup.

Utilizing one machine for all the pieces.A compromised telephone or laptop computer can expose your pockets. Devoted or clear gadgets scale back threat.

Assuming you may repair errors later.Blockchain transactions are last. There is no such thing as a undo button.

Tips on how to Retailer Crypto Safely with Self-Custody

Protected self-custody comes right down to good habits, not instruments. The correct setup reduces threat lengthy earlier than one thing goes incorrect. Listed below are a couple of tricks to get you began:

Use a {hardware} pockets for long-term storage.A {hardware} pockets retains your personal information offline. This protects your belongings from malware and distant assaults. It’s the most secure possibility for holding bigger quantities.

Hold your seed phrase offline and preserve it safe.Write it on paper or engrave it on steel. By no means retailer it on a telephone, cloud drive, or pc. Digital copies create straightforward assault paths.

Use safe bodily storage.Retailer backups in a fireproof and waterproof location. Think about using two places to cut back single-point failure.

Separate entry from storage.Don’t preserve your {hardware} pockets and restoration phrase collectively. If somebody finds each, safety is gone.

Check restoration earlier than trusting it.Get well your pockets utilizing the seed phrase on a clear machine. Verify it really works earlier than storing actual worth.

Restrict publicity.Hold spending funds in a software program pockets. Hold long-term holdings in chilly storage.

Defend your gadgets.Use robust passwords, machine encryption, and updates. Deal with each machine as a safety boundary.

Varieties of Self-Custody Wallets

Virtually all self-custody pockets varieties work in primarily the identical manner. Nonetheless, every kind balances safety, comfort, and threat in a different way. Let’s have a look.

{Hardware} Wallets

This can be a bodily machine constructed to retailer your crypto securely offline. It retains delicate information remoted from the web, which makes distant assaults far more durable. Transactions are signed internally, so secret info by no means touches your pc or telephone. Even when your laptop computer has malware, the pockets stays protected. {Hardware} wallets work finest for long-term storage. Many individuals use them to guard bigger quantities and solely join them when they should transfer funds.

Learn extra: What Is a {Hardware} Pockets?

Software program Wallets

A software program pockets runs in your telephone or pc. It connects to the web, which makes it a sort of sizzling pockets. That makes it straightforward to make use of but additionally will increase publicity to threats. These wallets are common for every day exercise. They allow you to ship, obtain, and work together with apps shortly. Most individuals use them for smaller balances or frequent transactions. They commerce comfort for greater threat.

Paper Wallets

A paper pockets is a bodily copy of your seed phrase or personal key, often printed or written down. That makes it a sort of chilly pockets. It accommodates the knowledge wanted to entry your funds with none digital storage. This methodology removes on-line assault threat, nevertheless it introduces bodily threat. Paper can burn, tear, fade, or be misplaced. If somebody finds it, they will take all the pieces. Paper wallets work provided that saved extraordinarily rigorously. Right now, they’re much less widespread, however some nonetheless use them for deep chilly storage.

Last Ideas: Is Self-Custody Proper for You?

Self-custody offers you actual possession, actual management, and actual accountability. It removes middlemen and places you in control of your belongings. In the event you worth independence, perceive the fundamentals, and are prepared to guard your setup, self-custody is price it. If not, begin small and study first.

FAQ

Is self-custody just for individuals with massive quantities of crypto?

No. You need to use self-custody at any degree. Many individuals begin with small quantities to learn the way wallets work earlier than storing bigger balances.

How can I inform if a pockets is custodial or non-custodial?

If the service holds your keys or can freeze entry, it’s custodial. In the event you management the restoration phrase and nobody else can entry your funds, it’s a non-custodial pockets.

Can I exploit each a custodial change and a self-custody pockets?

Sure. Many individuals purchase or commerce on exchanges, then transfer funds to self-custody for storage. This balances comfort with management.

Disclaimer: Please word that the contents of this text are usually not monetary or investing recommendation. The knowledge offered on this article is the creator’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native rules earlier than committing to an funding.