With Bitcoin wanting as bullish as ever, the inevitable query arises of how excessive may BTC realistically go on this market cycle? Right here we’ll discover a variety of on-chain valuation fashions and cycle timing instruments to determine believable value targets for a Bitcoin peak. Though prediction isn’t an alternative choice to disciplined knowledge response, this evaluation provides us frameworks to raised perceive the place we’re and the place we is perhaps heading.

Value Forecast Instruments

The journey begins with Bitcoin Journal Professional’s free Value Forecast Instruments, which compile a number of traditionally correct valuation fashions. Whereas it’s at all times simpler to react to knowledge quite than blindly predict costs, learning these metrics can nonetheless present highly effective context for market habits. If macro, by-product, and on-chain knowledge all begin flashing warnings, it’s often a stable time to take revenue, no matter whether or not a particular value goal has been hit. Nonetheless, exploring these valuation instruments is informative and may information strategic decision-making when used alongside broader market evaluation.

Among the many key fashions, the High Cap multiplies the typical cap over time by 35 to venture peak valuations. It precisely forecasted 2017’s prime, however missed the 2020–2021 cycle, estimating over $200k whereas Bitcoin peaked round $69k. It now targets over $500k, which feels more and more unrealistic. A step additional is the Delta High, subtracting the typical cap from the realized cap, primarily based on the price foundation of all circulating BTC, to generate a extra grounded projection. This mannequin advised an $80k–$100k prime final cycle. Essentially the most constantly correct, nevertheless, is the Terminal Value, primarily based on Provide Adjusted Coin Days Destroyed, which has carefully aligned with every prior peak, together with the $64k prime in 2021. Presently projecting round $221k, it may rise to $250k or extra, and stays arguably probably the most credible mannequin for forecasting macro Bitcoin tops. In fact, extra info relating to all of those metrics and their calculation logic may be discovered beneath the charts on the positioning.

Peak Forecasting

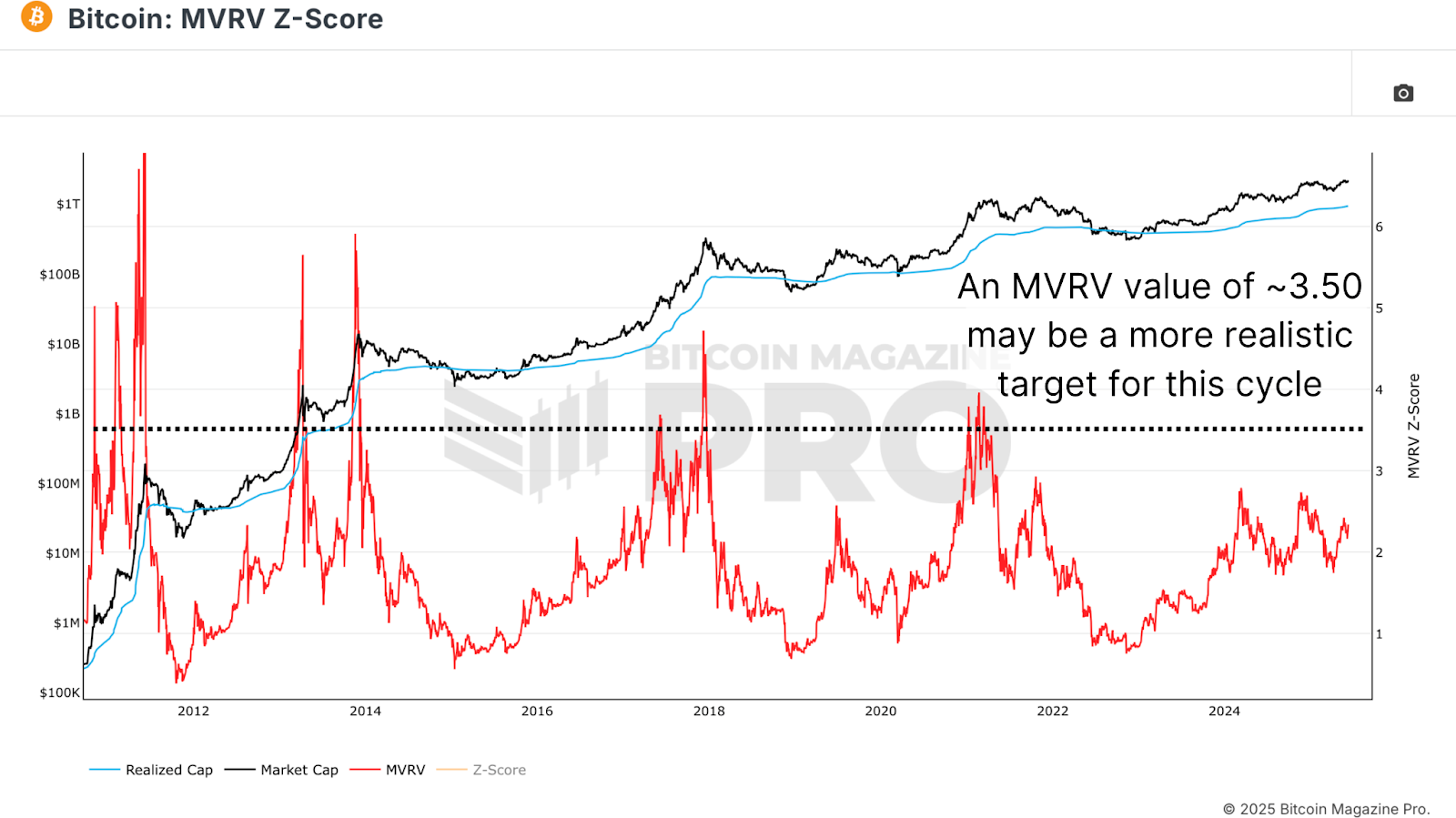

One other highly effective metric is the MVRV ratio, which compares market cap to realized cap. It affords a psychological window into investor sentiment, sometimes peaking close to a worth of 4 in main cycles. The ratio at the moment sits at 2.34, suggesting there should be room for vital upside. Traditionally, as MVRV nears 3.5 to 4, long-term holders start to understand substantial positive aspects, usually signaling cycle maturity. Nevertheless, with diminishing returns, we would not attain a full 4 this time round. As a substitute, utilizing a extra conservative estimate of three.5, we will start projecting extra grounded peak values.

Calculating A Goal

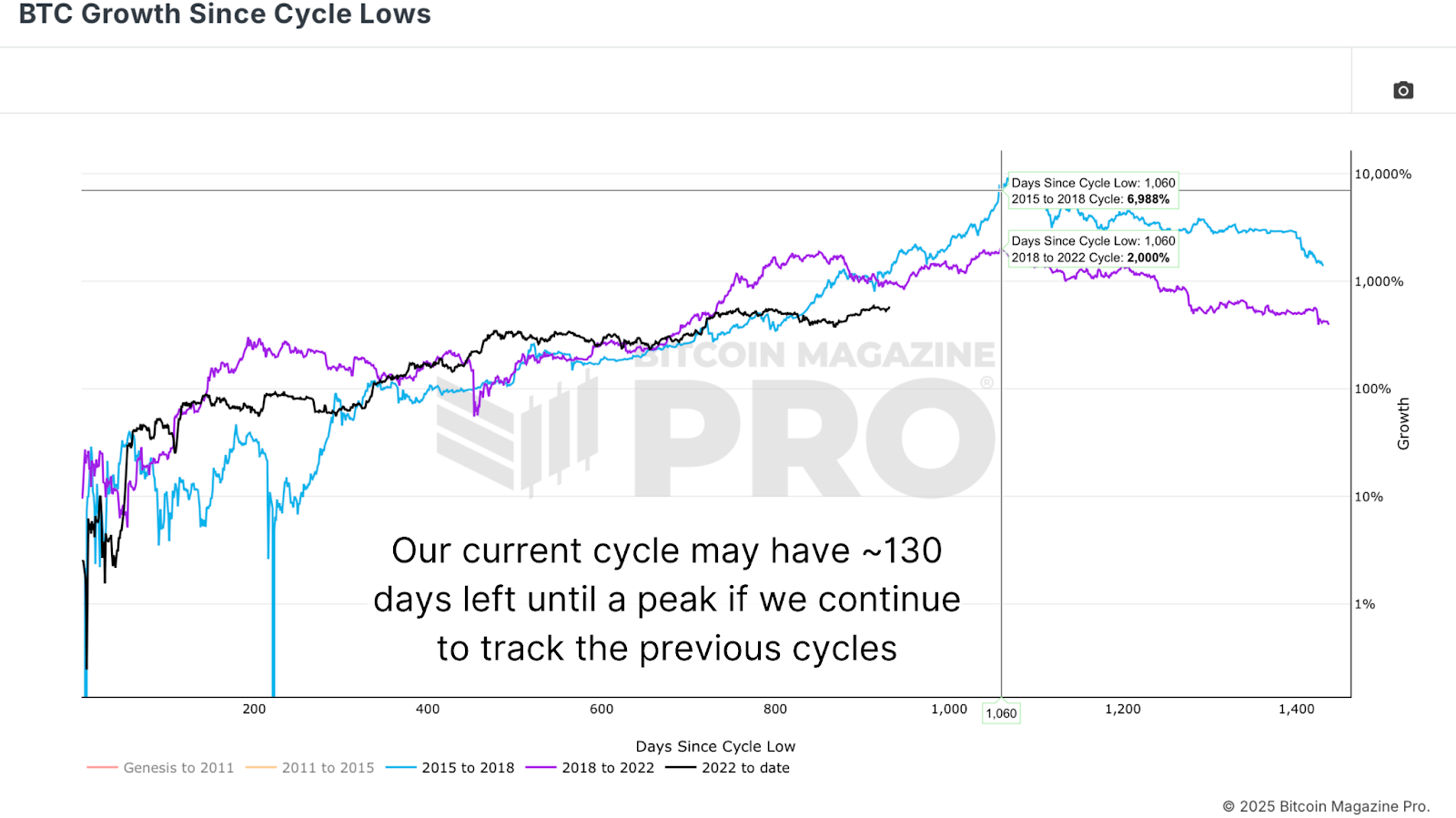

Timing is as necessary as valuation. Evaluation of BTC Progress Since Cycle Lows illustrates that earlier Bitcoin cycles peaked nearly precisely 1,060 days from their respective lows. Presently, we’re about 930 days into this cycle. If the sample holds, we will estimate the height could arrive in roughly 130 days. Historic FOMO-driven value will increase usually occur late within the cycle, inflicting Realized Value, a proxy for common investor value foundation, to rise quickly. For example, within the last 130 days of the 2017 cycle, realized value grew 260%. In 2021, it elevated by 130%. If we assume an extra halving of development resulting from diminishing returns, a 65% rise from the present $47k realized value brings us to round $78k by October 18.

With a projected $78k realized value and a conservative MVRV goal of three.5, we arrive at a possible Bitcoin value peak of $273,000. Whereas which will really feel formidable, historic parabolic blowoff tops have proven that such strikes can occur in weeks, not months. Whereas it might appear extra lifelike to anticipate a peak nearer to $150k to $200k, the mathematics and on-chain proof recommend {that a} larger valuation is no less than throughout the realm of chance. It’s additionally value noting that these fashions dynamically modify, and if late-cycle euphoria kicks in, projections may shortly speed up additional.

Conclusion

Forecasting Bitcoin’s actual peak is inherently unsure, with too many variables to account for. What we will do is place ourselves with probabilistic frameworks grounded in historic precedent and on-chain knowledge. Instruments just like the MVRV ratio, Terminal Value, and Delta High have repeatedly demonstrated their worth in anticipating market exhaustion. Whereas a $273,000 goal may appear optimistic, it’s rooted in previous patterns, present community habits, and cycle-timing logic. Finally, the most effective technique is to react to knowledge, not inflexible value ranges. Use these instruments to tell your thesis, however keep nimble sufficient to take earnings when the broader ecosystem begins signaling the highest.

For extra deep-dive analysis, technical indicators, real-time market alerts, and entry to a rising neighborhood of analysts, go to BitcoinMagazinePro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. All the time do your individual analysis earlier than making any funding selections.