Written by: The MacroButler

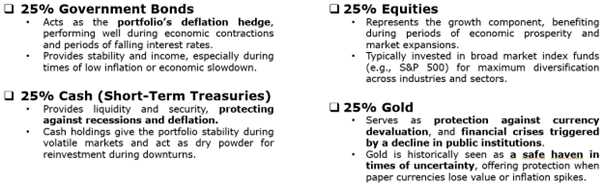

Harry Browne’s Everlasting Portfolio is mainly a four-course monetary meal: shares for the inflationary sugar rush, bonds for the deflationary nap, gold for the inflationary hangover, and money for when the whole lot else goes sideways. The genius lies in its stability—it doesn’t matter what the economic system cooks up, at the very least one dish is at all times edible. Layer in Schumpeter’s enterprise cycle, and also you’ve obtained a cheat sheet for figuring out which plate to pile larger. The trick, in fact, is determining which course the economic system is presently serving—simpler mentioned than executed.

If Harry Browne’s Everlasting Portfolio is the monetary gradual cooker: toss in shares, bonds, money, and gold, then let it simmer by booms, busts, bubbles, and panics, the combo is designed to outlive any financial temper swing—with out you needing antacids or day-trading stress. Consider it as portfolio geometry: a neat four-square grid the place at the very least one nook at all times behaves, maintaining your wealth from staging a coup.

Monetary property boil down to 2 tribes: contracts (IOUs like bonds) and properties (possession claims like shares). Some play the lengthy sport (authorities bonds, equities), others are short-term sprinters (money, gold). Put them on a grid—contracts vs. properties, lengthy vs. quick—and voilà: the “ceaselessly portfolio” splits neatly into 4 quadrants, like a well-behaved pizza the place each slice handles a unique financial temper swing.

In Browne’s Everlasting Portfolio, gold performs the position of timeless trouble-shooter. It’s been cash, jewelry, and a shiny obsession for millennia—however in fashionable finance it’s the last word “break glass in case of emergency” asset. Not like fiat, it could possibly’t be printed on a whim, which makes it scarce, sturdy, and annoyingly exhausting to kill. Central banks stash it in vaults, buyers cling to it in crises, and each time inflation, foreign money shenanigans, or geopolitical chaos hit, gold dusts off its cape and steps in because the safe-haven hero.

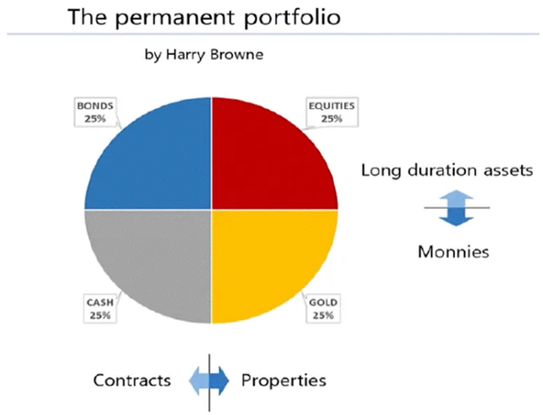

Gold has been humanity’s go-to cash and wealth preserver for millennia—uncommon, sturdy, and universally trusted. From Lydia’s first cash to Rome’s solidus to the gold-backed {dollars} of current historical past, it’s outlasted empires and paper guarantees alike. Not like fiat that governments can inflate at will, gold retains its shopping for energy—whether or not it’s a toga in historical Rome or a tailor-made swimsuit immediately. Via wars, crashes, and revolutions, it stays the identical: the last word anchor of belief when the whole lot else wobbles.

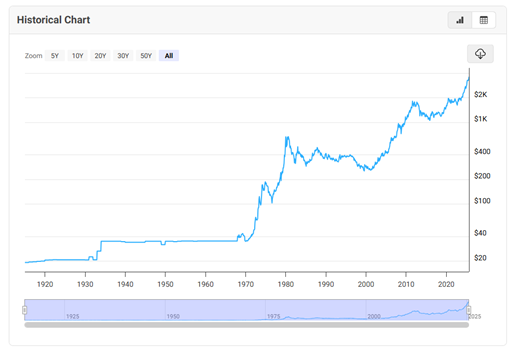

Gold’s place in a portfolio is endlessly debated. Whereas it’s typically billed as an inflation hedge, the information says in any other case: over practically a century, the 12-month correlation between gold costs and U.S. CPI has not often topped 0.5. In different phrases, gold is not any dependable short-term defend towards rising costs. Its worth lies much less in monitoring inflation tick-for-tick, and extra in serving as a long-term retailer of belief when paper cash wobbles.

Gold Worth in USD (blue line); US CPI City Shoppers Index (pink line) & Correlation since 1929.

Alright, myth-busters, put down your Wall Road popcorn—time to see if gold actually dances to the tune of inflation expectations. The “gold = inflation hedge” gospel preached by numerous buyers? Yeah… not so quick. Even after we ditch the short-term shopper noise and peek on the College of Michigan’s 5–10-year inflation expectations, gold’s correlation with long-term expectations is just barely higher than its laughable hyperlink with the U.S. “CP-Lie.” In brief: gold may twirl round inflation a bit, nevertheless it’s definitely not main the conga line.

Gold Worth in USD (blue line); College of Michigan Anticipated Change in Costs Throughout the Subsequent 5-10 Years (pink line) & Correlation since 1979.

So, if gold isn’t dancing to the inflation beat, what’s shifting the shiny metallic? Enter one other Wall Road fantasy: the concept that the greenback calls the photographs. Positive, gold is priced in USD, so when the greenback flexes its muscular tissues towards different fiat currencies, gold tends to sulk. Living proof: the Nineteen Eighties and Nineties—robust greenback, even with inflation lurking, and gold mainly shrugged. Have a look at the numbers: since 1967, gold and the USD Index (DXY) have principally been frenemies, negatively correlated with a typical correlation under -0.5. Translation: when the greenback struts, gold typically sits it out.

Gold Worth in USD (blue line); US Greenback Index (pink line) & Correlation since 1967.

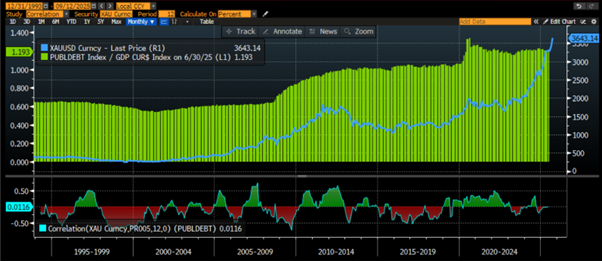

Gold is the unique “don’t-need-a-boss” asset. No counterparty, no intermediary, simply pure antifragile revolt towards financial chaos and authoritarian governments. Unsurprisingly, debt-heavy governments hate it—Roosevelt confiscated it, the Soviets banned it, Venezuela hawked it overseas—as a result of nothing cramps a ruler’s type like a shiny metallic they’ll’t inflate away. And but, gold persists. In the meantime, in the event you have a look at its correlation with U.S. debt-to-GDP, buyers sometimes look at it as a hedge… however principally, they only admire it from afar.

Gold Worth in USD (blue line); US Complete Debt to GDP (inexperienced histogram) & Correlation since 1993.

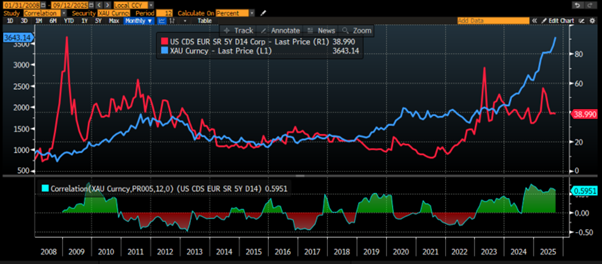

Effectively, who might’ve guessed? The one asset that’s managed to survive empires, currencies, and a thousand authorities IOUs—gold—simply so occurs to be the one factor buyers can really belief. Stunning, proper. And lo and behold, for the previous 17 years, its worth in USD has danced fairly intently with the US CDS price, that little metric that supposedly tells us the “true” threat of Uncle Sam defaulting. However certain, maintain pretending authorities paper is risk-free.

Gold Worth in USD (blue line); US Credit score Default Swap (pink line) & Correlation since 2008.

Naturally, the U.S. will nobly wait its flip to be the final Western authorities to default—such manners! And as for the charts displaying gold shifting in lockstep with French, British, and Japanese bond yields? Simply blissful accidents, like spilled wine on a white shirt. In any case, who nonetheless would belief debt-bloated governments to maintain the whole lot completely beneath management?

Higher Panel: Gold Worth in EUR (blue line); 30-Yr French Authorities Bond Yield (pink line); Center Panel: Gold Worth in GBP (inexperienced line); UK 30-Yr UK Authorities Bond Yield (purple line); Decrease Panel: Gold Worth in JPY (Magenta line); 30-Yr Japan Authorities Bond Yield (orange line).

To be clear, warning is important: it’s all too simple to mistake coincidence for causation—or to cling to a sample that immediately collapses. Keep in mind when everybody swore actual yields dictated gold costs? Then got here 2023, and—shock! —the idea fell flat.

Gold Worth in USD (blue line); US 10-Yr Actual Yield (axis inverted; pink line) & correlation since 1997.

These days, gold’s been the belle of the funding ball—outshining most different property that mere mortals and establishments can really purchase. Its current worth rise? A cocktail of macro chaos, structural quirks, and geopolitical drama—mainly the whole lot that makes buyers clutch shiny rocks like they’re life preservers.

Nominal (not ‘CP-Lie’ adjusted) efficiency of $100 invested in bodily gold (blue line); S&P 500 index (pink line); Bloomberg US Treasury Index (inexperienced line); Bloomberg US Treasury Invoice: 1-3 Months Index (purple line) since 31/12/2019.

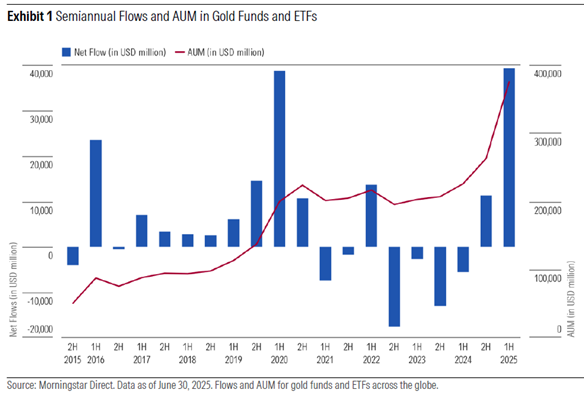

Persistent chaos, weaponization of USD property make gold appear to be the last word “don’t let your wealth soften” asset. Throw in commerce spats, and regional conflicts, and voilà—gold turned the gang’s favorite secure haven. Some buyers purchased it for diversification; others simply hopped on the momentum bandwagon—as a result of nothing says “sensible portfolio transfer” like chasing shiny rocks. Central banks, retail, and establishments piled in, pushing gold ETFs previous USD 375 billion by mid-2025—up sixfold from a decade in the past. Inflows within the first half of 2025 alone hit USD 40 billion, matching the panic-buying frenzy of early COVID, proving that when concern strikes, gold nonetheless steals the present.

Savvy buyers know gold isn’t simply shiny—it’s antifragile. The economic system swings by enterprise cycles—normally seven years on common—shifting between inflationary booms, busts, and deflationary phases. The Browne Everlasting Portfolio, equally weighted in money, bonds, shares, and gold, goals to ship regular actual returns throughout these cycles—peace allowing. However in immediately’s turbulent world, the place full-scale conflict hasn’t but hit however storms rage nonetheless, buyers want greater than a data-driven compass—they want an asset that really advantages from chaos.

An antifragile asset is an funding that doesn’t simply survive market chaos—it thrives on it. Coined by Nassim Nicholas Taleb, the idea describes property that develop stronger amid volatility, shocks, or crises, not like merely resilient investments that simply endure stress. Antifragile property usually characteristic a convex response to stress, optionality to profit from surprising alternatives, uneven payoffs the place potential features far outweigh losses, and low mounted obligations to cut back fragility. In brief, they provide buyers a uncommon edge in unsure instances, making them a strong addition to any portfolio—gold being the one tangible instance.

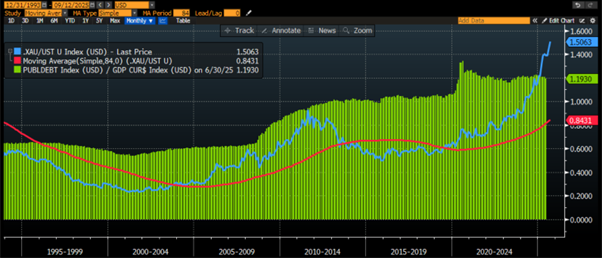

Whereas most individuals obsess over government-fed “financial information” (aka the propaganda numbers), savvy buyers know the true story comes from the market itself. Neglect the CPI—anybody who can learn a chart is aware of that monitoring gold versus authorities bonds tells you way more about foreign money debasement and inflation than a bureaucrat’s spreadsheet ever might. When debt-to-GDP begins sprinting upward, the gold-to-bond ratio normally follows, typically breaking above its 7-year shifting common like a insurgent with a trigger. Gold has grabbed investor consideration not too long ago, because of commerce wars and geopolitical drama, and whereas it could possibly diversify portfolios and enhance risk-adjusted returns, it’s no miracle asset—short-term swings could be wild, and chasing momentum is a quick observe to disappointment.

Gold to US Bond ratio in USD (blue line); 7-Yr Shifting Common of the Gold to US Bond ratio (pink line); US Complete Debt to GDP (inexperienced histogram) since 1993.

On the geopolitical entrance, the primary week of September made one factor clear: the World South retains assembling its personal financial and monetary dream crew. On the twenty fifth SCO Summit in Tianjin (Aug 31–Sept 1, 2025), China flexed its management, internet hosting the biggest gathering in SCO historical past with Putin and Modi—India’s first return in seven years. The summit rolled out a 10-year improvement plan, backed multilateralism, and greenlit an SCO Growth Financial institution together with cooperation platforms in power, AI, and inexperienced tech—quietly nudging towards U.S. dominance. Xi’s “World Governance Initiative” pitched a mannequin primarily based on sovereign equality and higher Southern illustration, whereas an informal picture of Xi, Modi, and Putin completely symbolized the rising multipolar world order.

The launch of the SCO Growth Financial institution at Tianjin is a daring stride towards lowering dependence on Western finance and the U.S. greenback. By pooling member sources and financing tasks in native currencies, it strengthens regional resilience and nudges cross-border commerce towards yuan, rubles, and rupees. Very similar to the BRICS New Growth Financial institution, it indicators a gradual however regular shift of worldwide capital away from Western hubs towards the World South and Eurasia. Historical past repeats: simply as Bretton Woods cemented U.S. dominance after WWII, the SCO’s transfer hints at a brand new monetary inflection level—one the place unipolarity offers method to a multipolar world order.

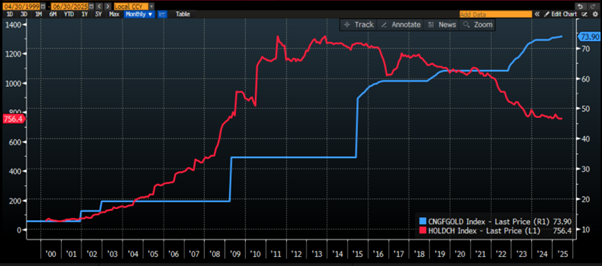

Putin, Xi, and Modi are quietly rewriting the playbook: de-dollarizing commerce throughout the World South, constructing non-SWIFT settlement programs to dodge Washington’s monetary sledgehammer, and diversifying central financial institution reserves away from U.S. Treasuries. The numbers inform the story—over the previous decade, China’s gold reserves have steadily climbed, whereas its U.S. Treasury holdings have quietly retreated in the wrong way. Gold is again in type.

China Month-to-month Gold Reserves (blue line); China US Treasury Holdings (pink line).

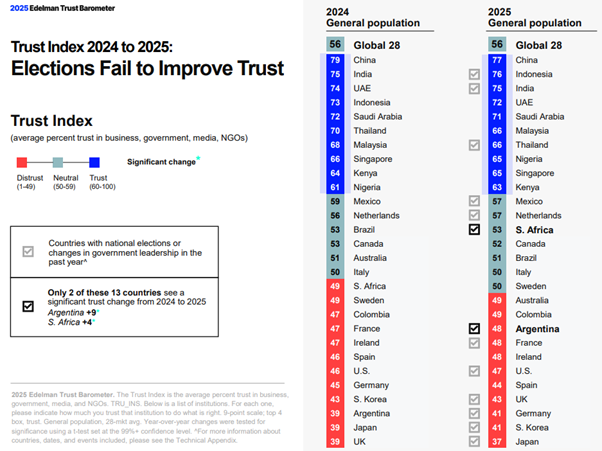

Amid the issues of the USD-centric monetary system, gold gives freedom—from credit score threat, authorities meddling, and geopolitical tantrums like freezing international property. As belief in public establishments falters and geopolitical tensions rise, each institutional and retail buyers are gravitating towards property with no counterparty threat. Enter gold: the last word antifragile asset, quietly thriving whereas paper guarantees wobble.

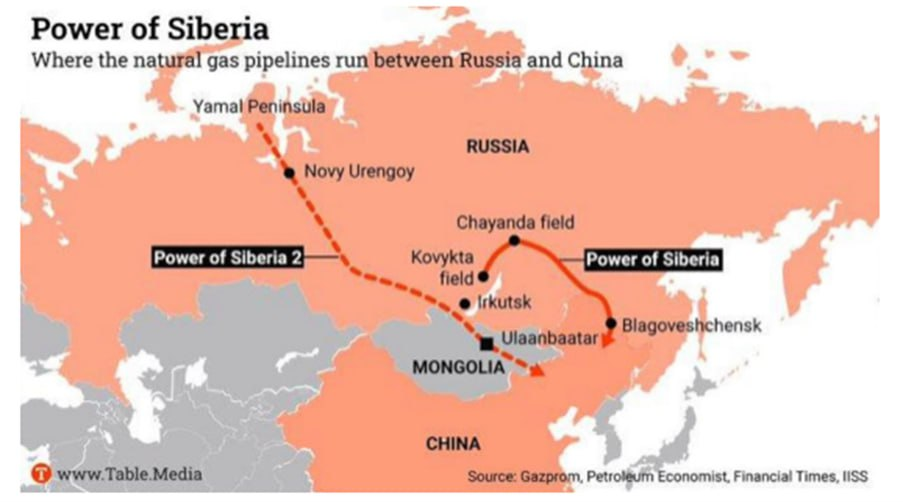

Whereas Western media retains freting over carbon credit and advantage factors, the “mercantilist” World South was busy in Tianjin plotting new overland pipelines to maneuver oil and fuel from Russia to China. Gazprom and CNPC quietly signed one other fuel deal—simply extra proof that Russia and China are steadily weaving their financial net, whereas the West debates inexperienced optics and one other spherical of financial sanctions towards the Russian Bear.

Whereas the U.S. clings to its naval supremacy, the World South is busy constructing roads—and pipelines. Gazprom and CNPC are pushing the world’s largest, most capital-intensive fuel pipeline from Russia’s Arctic throughout Siberia to China. With Beijing already Russia’s prime purchaser of oil, fuel, and coal, this isn’t a “new deal”—it’s topping off an already full tank. Europe? You’re cheering inexperienced zealots and warmongers whereas sleepwalking towards financial damage. In the meantime, China cements power independence and world clout, quietly profitable the infrastructure arms race of the century.

On the finish of the day, anybody who research markets is aware of GOLD IS FOR WAR. Harsh? Historical past proves it: when pillaging turns into acceptable, ethical and spiritual excuses comply with. Trendy myths don’t assist: low rates of interest magically create wealth (inform that to People priced out of property), authorities stimulus drives progress (actual progress comes when returns on invested capital beat the price of capital, nothing else), and discouraging saving doesn’t enhance the economic system as everybody who has not been brainwashed by the communist keynesian religions know.

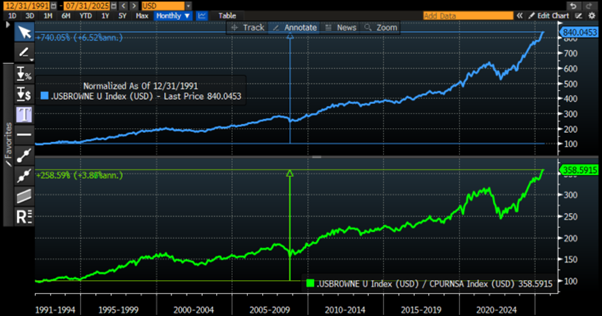

But many nonetheless reward U.S. financial administration over China’s, judging by inventory markets alone—ignore the Browne Portfolio returns of their respective home currencies: 3.89% yearly when adjusted for home CPI in China versus 3.85% for the U.S., additionally adjusted for home CPI. The distinction: in China, all parts are within the inexperienced, fostering equity and political stability.

US Browne Portfolio in USD (blue line); US Browne Portfolio in USD adjsuted to US CPI (inexperienced line).

China Browne Portfolio in CNY (blue line); China Browne Portfolio in CNY adjsuted to US CPI (inexperienced line).

Asset allocation skeptics ask: why hassle if the Everlasting Portfolio delivers 3–4% actual returns with minimal drawdowns? Easy: it really works in peace. In wartime, money and bonds crumble—France noticed debt securities lose 97% of actual worth between 1914 and 1950. Gold, however, retains its shine.

In a nutshell, even in monetary disasters sparked by conflict, the Everlasting Portfolio by no means hits zero—thank the 25% gold allocation for that. In the meantime, the concept that authorities bonds and money are “risk-free” is cute… in the event you’ve by no means lived the place governments can’t stability a finances. Take Ukraine: it narrowly prevented defaulting on $20 billion in loans in July, after suspending curiosity funds for 2 years because of the conflict—a default that might have ranked among the many ten largest in current historical past. Historical past teaches that conflict cycles erode confidence in public establishments and wreak havoc on asset allocations. Because the 2020s roll on, wars rise, belief falls, and mismanaged Western governments maintain piling debt for the advantage of the 1%, leaving the remaining scrambling. On this local weather, gold isn’t non-obligatory—it’s obligatory.

Gold and conflict have at all times danced collectively. Spain’s New World silver financed conquest however sparked home inflation, weakening it for future conflicts whereas England and the Netherlands profited by supplying items. Throughout the French and Napoleonic Wars, Britain deserted the gold customary in 1797 however leveraged its monetary credibility to borrow closely, whereas France’s bimetallic method restricted borrowing and compelled reliance on taxation—tilting the benefit to Britain. By World Warfare One, Imperial Russia’s huge gold reserves had been drained within the chaos, with Bolsheviks seizing personal and Imperial gold to maintain their revolution. In the meantime, the Allies’ gold—particularly from Britain and South Africa—financed conflict efforts and blocked Germany’s entry. Germany preserved smaller reserves, lending gold to allies just like the Ottoman Empire. These patterns repeated in World Warfare Two, as Nazi Germany plundered gold from occupied territories to fund its conflict machine. World Warfare Three is not going to be a lot completely different and those that are nonetheless believing in bonds and money to protect their wealth would be the first collateral victims of the warmongering agenda of the ‘North Atlantic Terror Group’ alias NATO and different Malthusian western globalist group just like the European Union or the membership of the elite males of Davos.

For buyers, wartime circumstances are a complete new ballgame. In such chaos, gold shines brightest, gaining towards beta as volatility spikes. When inventory market threat metrics climb, the gold-to-S&P 500 ratio normally rises, letting gold outperform equities. This pattern is much more related immediately, as U.S. property face weaponization by governments and the comfortable China-Russia-India alliance fuels gold demand throughout the World South.

Relative Efficiency of S&P 500 index to Gold Ratio (blue line); CBOE Volatility Index 200 day shifting common (VIX Index) (axis inverted; pink line).

For individuals who really perceive financial illusions, it’s apparent: when the S&P 500-to-Gold ratio dips under its 7-year shifting common, historical past whispers “Ursus Magnus” — aka, a serious bear market. However in fact, YOLO buyers glued to CNBC and different mass-media fairy tales are blissfully oblivious. Since Donald Copperfield waltzed into the Oval Workplace on January 20, 2025, that very ratio has been flirting under its 7-year shifting common—a canary within the coal mine that apparently no one desires to note.

Relative Efficiency of S&P 500 index to Gold Ratio (blue line); 7-Yr Shifting Common of S&P 500 index to Gold Ratio (pink line); S&P 500 index 12-month return (yellow histogram).

The markets are mainly telling buyers that taking dangers now not pays—and that’s what actually issues. That’s all buyers have to know. As for why—properly, that’s irrelevant. Actually, the day we lastly perceive why threat doesn’t pay will most likely be the right day to begin shopping for.

Right here’s the trick: shares and gold take turns carrying the crown. Since 1970, S&P 500 dividends have at all times drifted again to about one gram of gold, irrespective of how a lot Wall Road pats itself on the again. Translation: most of that “progress” is simply financial smoke and mirrors. So, purchase shares once they’re filth low-cost versus gold (S&P 500 dividend to 1 gram ratio beneath 0.56) and promote once they’re dear (ratio over 1.3). Proper now, the ratio is already flashing hazard, and if it dips under 0.5630, that’s the cue to flip gold into shares.

Till then, one of the best commerce is… doing completely nothing. Preserve the powder dry, as a result of when the correction in fairness comes, it’ll be quick, ugly, and terrifying. And truthfully, that’s when sensible buyers make cash—shaking of their boots whereas everybody else is operating for the exits. Everybody ought to be excited to be terrified once more.

S&P500 Dividend Per Share in {dollars} (blue) and in gold grams (pink).

Certainly when the dividend of the S&P 500 expressed in gram of gold commerce under 0.56 grams the 12 month return within the S&P 500 tends to have peaked and has solely troughed as soon as a reversal has been began to materialize within the valuation of S&P 500 dividend in gold phrases. In a nutshell, for individuals who anticipate that fairness return will stay in double digit as they’ve been over the previous 2 years they need to imagine that the tempo of S&P 500 dividend progress can be a lot larger than the tempo of worth appreciation of 1 gram of gold. As stagflation looms on the horizon, these hopes might seemed to be elusive.

S&P500 Dividend Per Share gold grams (pink); 12-month return of S&P 500 index (yellow histogram).

To the goldbugs who cling to their very own fairy tales, let me prevent the headache: believing solely gold survives whereas fiat currencies are doomed is pure nonsense. Historical past exhibits that for hundreds of years, cash wasn’t metallic in any respect—it was simply guide entries in historical Egyptian banks, backed by grain, not gold. Cash appeared centuries later, typically imitating essentially the most trusted international foreign money, like Athenian Owls or Roman aurei. Their worth wasn’t within the metallic; it was in belief—folks trusted Athens, Rome, or India greater than the metallic within the coin. Even the Celts copied Macedonian cash, and the Maria Theresia Thaler lived on for many years after her dying as a result of it was trusted internationally. In brief, cash has at all times been about belief, conference, and recognition—not simply shiny metallic. So, earlier than you curse “fiat,” bear in mind: people have been doing this for millennia, and it really works remarkably properly if you perceive the historical past.

Fortunately, you’ll by no means persuade a idiot that he’s a idiot. There’ll at all times be loads of these champions who refuse to pay attention—as a result of apparently, dropping their shirts, pants, home, automobile, partner, and perhaps even the canine is the one method to be taught. We be taught from errors, not wins. The excellent news? That leaves a wonderfully sized herd for the remainder of us to commerce towards.

historical past with open eyes, it’s clear Washington’s warmongers have been operating infinite wars—from Vietnam to the Warfare on Terror—none of which they’ve really gained. McNamara admitted Vietnam was a civil conflict, not a battle towards Russians. Iraq? No WMDs, no accountability, $8 trillion down the drain. Right now, EU leaders appear poised to select fights with Russia—not for safety, however to distract from financial failures and a flawed euro that would by no means exchange the greenback. Centralized governance was meant to forestall wars, but historical past—from Charlemagne to Napoleon, even Kohl sneaking Germany into the euro—exhibits it typically fails, sparking unrest as a substitute. Now, with ungovernable establishments and ballooning debt, conflict appears just like the EU’s solely method to save face, whereas NATO and lobbyists maintain milking the forever-war machine.

The inevitable World Warfare III is poised to shift the financial and monetary middle of gravity eastward, with China—and most definitely Hong Kong—rising as the brand new hub of worldwide capitalism. This is able to mark the eclipse of the globalist Keynesian agenda and the rise of a multipolar world pushed by mercantilist ambitions.

Within the meantime, as the worldwide economic system is heading into an inevitable inflationary bust, the trail to actual prosperity stays paved with tangible property, not fragile IOUs not genius digital tokens, Bodily gold and silver—free from counterparties, free from surveillance—stand as the last word antifragile shields. Past valuable metals, broader commodities guard towards a fracturing world provide chain.

Money have to be wielded with precision: favor short-dated USD investment-grade bonds and T-bills to keep up earnings and swift agility.

In equities, hunt for lean, low-debt, high-cash-flow champions—companies able to thrive amid reshoring, commerce wars, and surging protection budgets. As a result of the true enemy isn’t subsequent door; it’s the warmongers pulling the strings.

The Goldilocks period is useless. The age of Gold In Heaps—is the brand new survival playbook.

On the finish of the day, as Charles De Gaulle as soon as mentioned, “Betting towards Gold is similar as betting on authorities. He who bets on governments and authorities cash bets towards 6,000 years of recorded human historical past”

KEY TAKEWAYS.

As buyers lastly get up to why gold issues—and why it issues proper now—the important thing takeaways are:

Harry Browne’s Everlasting Portfolio is a four-quadrant monetary “pizza” of shares, bonds, gold, and money, designed to outlive any financial temper swing—no antacids or day-trading required.Gold is finance’s timeless superhero—scarce, sturdy, and able to protect wealth when inflation, foreign money chaos, or crises strike.Gold isn’t a short-term inflation defend—it’s a long-term retailer of belief that holds worth when paper cash wobbles.Gold: the last word “I don’t take orders” asset—antifragile, counterparty-free, and eternally annoying to debt-heavy governments, which explains confiscations from Roosevelt to the Soviets.Gold isn’t only a shiny relic—it’s an antifragile asset that thrives on chaos, giving buyers a uncommon edge by each twist of the financial cycle.When the S&P 500-to-Gold ratio breaks under its 7-year shifting common, historical past screams bear market forward—so whereas CNBC’s YOLO crowd cheers, the sensible cash is quietly ready to purchase in concern.Putin, Xi, and Modi are fuelling a world gold comeback, as buyers search the antifragile safety of metallic over wobbling paper guarantees and a USD-centric system in disaster.Because the US economic system shifts into an inflationary bust, buyers will as soon as once more have to concentrate on the Return OF Capital somewhat than the Return ON Capital, as stagflation spreads.Bodily gold and silver stay THE ONLY dependable hedges towards reckless and untrustworthy governments and bankers.Gold and silver are everlasting hedge towards “collective stupidity” and authorities hegemony, each of that are ample worldwide.With continued decline in belief in public establishments, notably within the Western world, buyers are anticipated to maneuver much more into property with no counterparty threat that are non-confiscable, like bodily Gold and Silver.Lengthy dated US Treasuries and Bonds are an ‘un-investable return-less’ asset class which have additionally misplaced their rationale for being a part of a diversified portfolio.Unequivocally, the dangerous a part of the portfolio has moved to mounted earnings and due to this fact somewhat than chasing long-dated authorities bonds, mounted earnings buyers ought to concentrate on USD investment-grade US company bonds with a length not longer than 12 months to handle their money.On this context, buyers also needs to be ready for a lot larger volatility in addition to uninteresting inflation-adjusted returns within the foreseeable future.

HOW TO TRADE IT?

As of September twelfth , 2025, the US stays in an inflationary increase, however with the S&P 500 to Gold ratio now under its yr under its 7-year shifting common for greater than 7 months, an inflationary bust will materialize a lot earlier than Wall Road pundits and their parrots are keen to inform their purchasers. On this context, buyers ought to keep calm, disciplined, and use market information instruments to anticipate modifications within the enterprise cycle, somewhat than fall into the ahead confusion and phantasm unfold by Wall Road.

As conflict casts its shadow, the clever perceive that true power arises from figuring out each oneself and the currents round them. Those that grasp the character of the enemy but stay blind to their very own path win solely fleeting victories; those that know neither are swept away by each storm, whether or not within the circulate of wealth or the chaos of battle.

In instances of conflict and monetary chaos, the clever know first what to not do: don’t belief fragile banks, sovereign bonds, or authorities guarantees, for they crumble when examined. As an alternative, search the enduring path—maintain bodily gold and silver in safe, impartial fingers, diversify throughout secure jurisdictions, and protect your freedom and choices. Scale back reliance on money and paper claims, favor tangible property that thrive in turmoil, and put together for shifts in energy and coverage past your management. Focus not on fleeting features however on the quiet artwork of staying wealthy, defending household, and valuing what’s freely given by life itself—whereas remembering the traditional reality: gold is for conflict.

Because the western imperialistic dominance stumbles by its boom-bust dying cycle and European unelected lamed geese autharitarian leaders put together their subsequent ‘false flag’, buyers need to comply with the gold as historical past’s verdict is unchanged: tangible property endure whereas paper guarantees burn. The long run is not going to be gained by those that innovate quickest, however by those that maintain what can’t be printed, censored, or erased. Gold has outlasted empires; it’ll outlast this one.

In a nutshell, the playbook is straightforward: don’t get confiscated, don’t get frozen, and don’t get poor making an attempt to get wealthy. In instances like these, liberty and liquidity dwell in private vaults—not in banks. And at all times bear in mind: In Gold We Belief—As a result of Gold Is For Warfare.

As William Rees-Mogg properly famous: ‘Governments lie; bankers lie; even auditors generally lie. Gold tells the reality.’

Need the complete deep dive? You’ll be able to learn The MacroButler’s authentic article on his Substack

https://themacrobutler.substack.com/p/why-gold-why-now