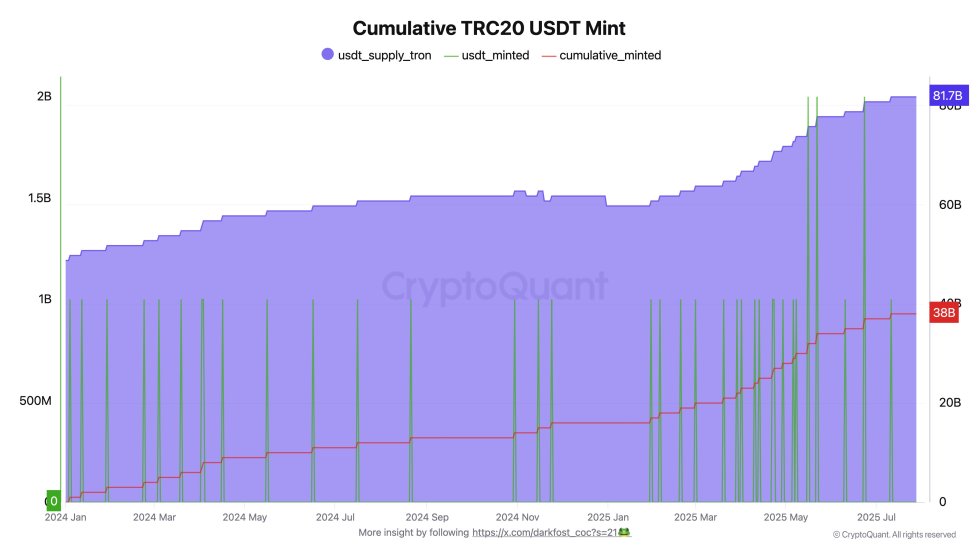

Tron continues to dominate the stablecoin panorama, with one other $1 billion in USDT minted simply yesterday—bringing the entire minted on the community in 2025 to a staggering $23 billion. This marks the strongest yr for USDT provide enlargement on Tron because the peak of the 2021 cycle. With this newest mint, the entire USDT provide on Tron now stands at $81.7 billion, additional solidifying its place because the main blockchain for Tether issuance.

Traditionally, large-scale USDT mints have been considered as bullish indicators for the broader crypto market. These occasions typically precede intervals of elevated liquidity, signaling that merchants and establishments are getting ready recent capital for strategic deployment. As USDT acts as a major on-ramp into crypto markets, its enlargement is carefully watched as a proxy for incoming demand.

The timing of this mint is particularly necessary, coming as Bitcoin consolidates close to all-time highs and altcoins present rising volatility. With capital prepared on the sidelines, many analysts imagine the market may very well be on the verge of one other enlargement section. If historical past is any information, Tron’s newest $1B mint might mark the start of a brand new wave of inflows throughout the digital asset ecosystem.

Tron’s $1B USDT Mint Indicators Daring Shift Towards Monetary Integration

Prime analyst Darkfost means that Tron’s newest $1 billion USDT mint is not like earlier ones—and will mark a turning level for the ecosystem. Not like normal mints, this $1B issuance has not but appeared on-chain. Based on the transaction hash, the funds had been transferred to a multisig pockets, the place they continue to be inactive, pending additional authorization.

No transaction charges had been paid, a powerful indicator that that is a listing replenishment mint approved by Tether however not but put into circulation. For now, it doesn’t mirror in on-chain provide metrics, however the intent behind it carries deeper implications.

What makes this mint particularly important is its timing. It comes simply days after Tron.inc was listed on Nasdaq and shortly after Justin Solar confirmed the submission of an S-3 submitting with the US Securities and Trade Fee (SEC). That submitting contains the proposed issuance of hybrid securities totaling precisely $1 billion—the identical quantity because the mint. These securities might take the type of widespread inventory, most well-liked shares, or debt devices.

The overlap in timing and worth suggests a coordinated technique: Tron could also be getting ready to intertwine conventional monetary devices with stablecoins in a capital-efficient, compliant construction. If true, this might be a precedent-setting transfer for the crypto house, positioning Tron not simply as a blockchain for transfers however as a totally built-in monetary platform.

This mint, although not but dwell on-chain, could also be step one in a broader imaginative and prescient that bridges TradFi and DeFi—leveraging stablecoin liquidity as a software for regulated fundraising and capital administration. For Tron, this may very well be essentially the most important improvement since its inception.

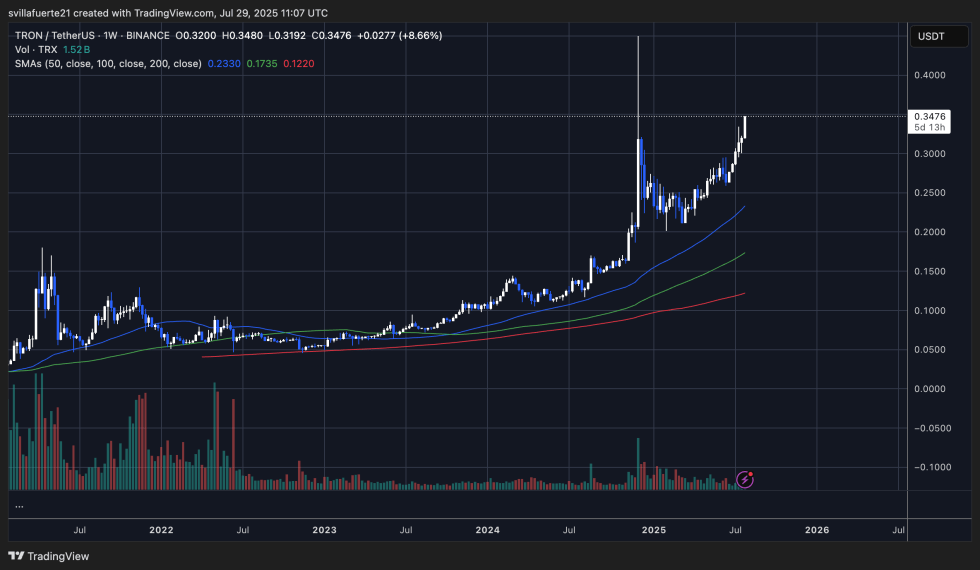

TRON Breaks Greater As Weekly Chart Indicators Bullish Continuation

TRX is displaying sturdy bullish momentum on the weekly chart, at present buying and selling at $0.3476 after gaining 8.66% within the final session. This transfer pushes TRX to its highest weekly shut since early 2022, breaking previous native resistance ranges and approaching its cycle excessive. The worth motion displays a well-structured uptrend that started in early 2023, supported by rising quantity and a transparent collection of upper highs and better lows.

The 50-week SMA ($0.2330), 100-week SMA ($0.1735), and 200-week SMA ($0.1220) are all trending upward and now lie far under the present value—confirming the power and maturity of the development. TRX stays firmly above all main assist zones, with no rapid indicators of exhaustion on the chart.

If TRX sustains above the $0.32–$0.34 vary, the subsequent main resistance might come close to $0.40. A clear weekly shut above present ranges would probably open the door to additional upside in Q3, particularly if broader market situations stay favorable.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.