It has been a difficult few weeks within the markets for traders. From a significant tech sell-off to bitcoin tumbling greater than 30%, current strikes have left many questioning whether or not this ferocious bull market is nearing its finish. There aren’t many traders who wouldn’t chunk your hand off for an end-of-year rally, besides possibly Michael Burry. The star investor lately warned in opposition to extreme market euphoria and, with brief positions in Nvidia and Palantir, is clearly betting on headwinds for the AI hype.

Tales like these gasoline the controversy within the markets, that are presently divided between hopes for a rally and considerations about valuations and market bubbles. Burry’s bets have left query marks for traders, and the current sell-off throughout danger belongings has some traders on edge. So, what actually issues proper now? Let’s discover out.

After a risky stretch for danger belongings, traders are hoping for a year-end enhance, however valuations are trying stretched.

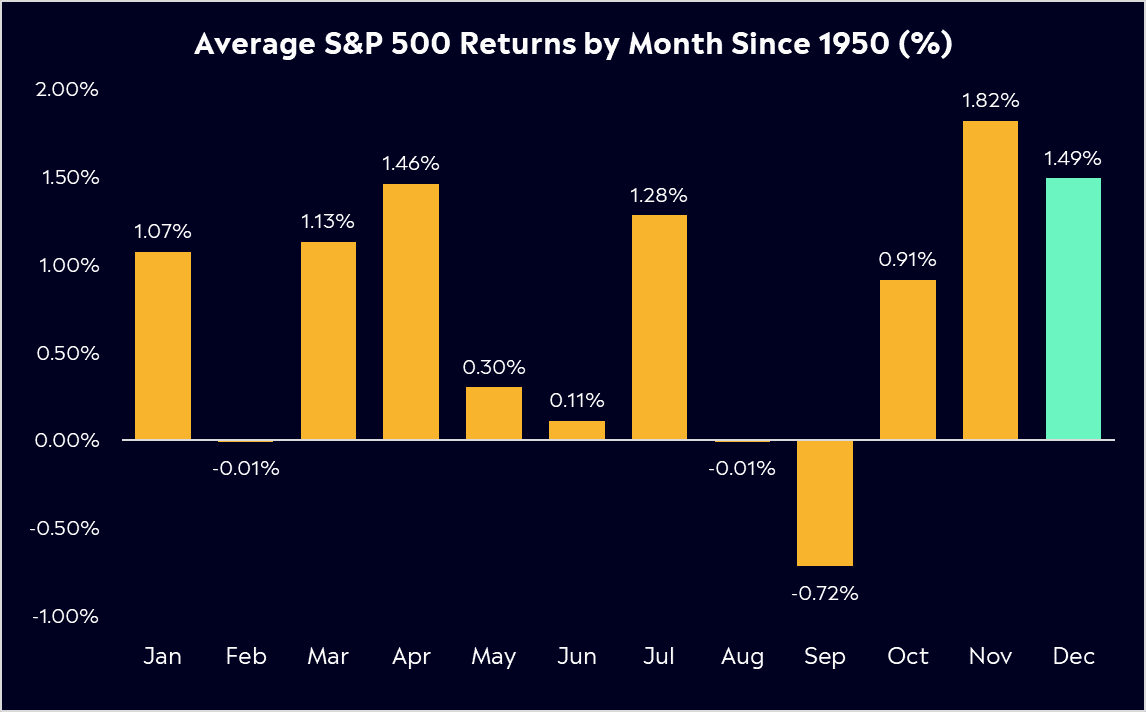

Historic information reveals an actual Santa Rally exists, with November and December one of the best performing months on common since 1950.

With markets divided between optimism and warning, staying diversified and centered on high quality is vital heading into 2026.

Investor Psychology

There is no such thing as a doubt that it’s been a terrific 12 months for markets. On Wall Avenue, the S&P500 is up 15%, whereas the Nasdaq has rallied 20% and in Asia, the Dangle Seng has delivered an enormous 29%. These returns are greater than historic averages, displaying how sturdy 2025 has been. Because the 12 months attracts to an in depth, investor psychology is now taking centre stage. Hardly anybody needs to promote and probably miss out on a year-end rally, typically dubbed the ‘Santa Rally’. This might make the market extra emotional and fewer rational. A “purchase the dip” mentality is prone to prevail, with traders viewing pullbacks as a possibility moderately than a warning signal, a development we’ve seen all through this 12 months.

It’s essential to do not forget that pullbacks are regular, and volatility is normal. Since 1974, the S&P 500 has averaged three pullbacks of 5% or extra annually, whereas the common intra-year pullback is roughly 14%. We’ve seen 5 corrections (10% declines from peak to trough) within the final 9 years, and since 1974, the S&P 500 has returned over 24% on common following a correction.

*Previous efficiency is just not an indicator of future outcomes

Causes for Optimism: The Bull Case

Regardless of the current noise and cautionary voices, there are stable causes for bullish optimism. Fundamentals, seasonality, and the macroeconomic local weather presently counsel a continuation of the rally or no less than steady costs till the tip of the 12 months. Inflation, though nonetheless risky, seems to be largely below management, and US tariff coverage has not triggered a brand new surge in inflation. Which means that rates of interest could be reduce additional subsequent 12 months.

Company earnings have additionally delivered the products. The third-quarter earnings season was broadly sturdy. Within the US, S&P 500 firm income are on observe to rise about 14% from a 12 months earlier, with a powerful majority of corporations beating expectations. This stable efficiency underpins the market’s positive aspects with actual earnings progress, not simply hype. Trying forward, analysts stay optimistic that earnings will proceed to climb into 2026. Forecasts name for double-digit revenue progress subsequent 12 months, roughly +13% for US corporations, as soon as once more supporting the bull case into subsequent 12 months.

Seasonality provides additional wind at traders’ backs. The top of the 12 months is traditionally a robust interval for equities. Since 1950, December has been among the many greatest months for the S&P 500, averaging positive aspects of 1.5%. This seasonal development, typically dubbed the “Santa rally,” bolsters investor confidence, it’s a sample many are desirous to see repeat. The frequent denominator is the repositioning of traders for a brand new 12 months. Trying forward 12 months, and when markets are inclined to rise, allocations are normally constructive. This could possibly be particularly sturdy this 12 months.

All these components, from benign inflation, supportive central banks, sturdy earnings, a seasonally good interval, and a respite from unhealthy information, make a compelling case that the rally can proceed or no less than maintain its floor by December.

*Previous efficiency is just not an indicator of future outcomes

Causes for Warning: The Bear Case

On the flip facet, it will be naive to be blindly complacent and never keep in mind causes to be cautious as we method year-end. Before everything is valuations. The S&P 500 now trades round 23 instances ahead earnings, a valuation a number of close to its highest stage in many years, and nicely above the index’s 10-year common of round 18-19. What does that imply in easy phrases? A number of excellent news is already baked into share costs. When valuations are elevated, markets develop into extra fragile, and traders are fast to react to any disappointment since there’s much less margin for error.

A lot of that excellent news has stemmed from the AI hype. There’s no denying that pleasure round synthetic intelligence has been a large driver of shares, with AI-related shares accounting for a substantial proportion of the S&P 500’s returns since 2022. Tech giants are investing a whole lot of billions of {dollars} to drive the AI revolution. Traders are primarily paying up now for the promise of AI riches later. It stays to be seen whether or not these huge AI investments will translate into long-lasting income.

Added to this are political uncertainties. The US authorities shutdown is the longest in historical past and will weigh on market confidence. A price reduce in December now appears unlikely, with the chance now solely round 15%. Markets are strolling a advantageous line between euphoria and overvaluation. The upper the valuation, the extra delicate traders could possibly be to damaging surprises. Minor pullbacks can be wholesome, however bigger corrections would want a transparent set off.

Navigating the Dangers

One factor that I all the time remind traders is that uncertainty is a continuing in markets, it by no means actually goes away and accepting that’s a part of the investing mindset.

One key level is that large market volatility normally has catalysts; it doesn’t come out of nowhere. Sharp swings are usually sparked by surprises that catch the gang off guard, maybe a sudden earnings miss, an surprising coverage transfer, or an exterior shock like a geopolitical battle. Whereas we are able to’t predict these occasions, we are able to typically put together for them.

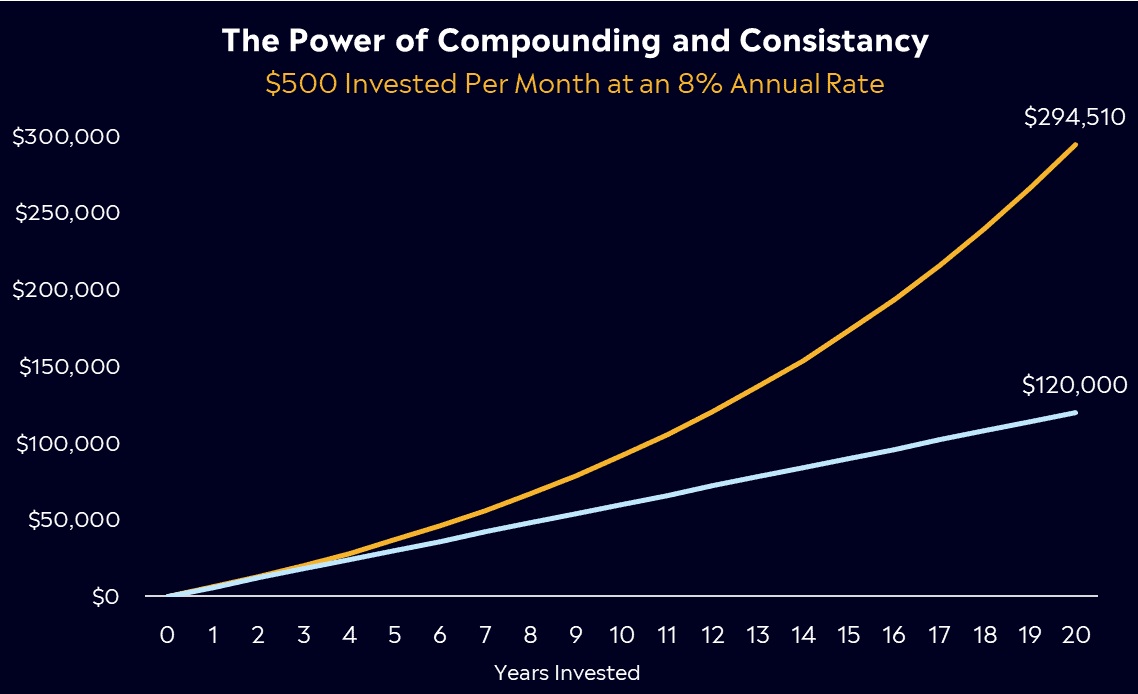

When you have a long-term investing plan, keep it up. A plan helps traders keep on with the nice concepts they got here up with throughout calmer instances. Those that persistently add to their long-term inventory publicity are inclined to do nicely over time. Promoting investments in a panic can lock in losses. Traditionally, markets rebound, and those that keep invested typically profit from the restoration.

The present volatility highlights the significance of diversification in an funding portfolio. By spreading investments throughout a wide range of belongings, diversification reduces the influence of any single asset’s poor efficiency. In instances of market turbulence, not all sectors or particular person shares react the identical method; some could even see positive aspects, which might help offset losses in different areas. This technique smooths out the volatility in a portfolio, offering a steadier return over time and main to higher risk-adjusted returns.

Let’s take an S&P500 ETF for example, reminiscent of SPY, VOO, or IVV. One of these ETF invests within the 500 largest publicly traded corporations within the US, providing broad market publicity. The S&P500 consists of a variety of industries reminiscent of know-how, healthcare, finance, and client items, which implies that the ETF is inherently diversified throughout a number of sectors. Throughout the S&P500, totally different sectors carry out in another way based mostly on varied financial circumstances. As an example, throughout a pullback within the know-how sector, different sectors like utilities or client staples could carry out higher, thereby cushioning the general influence on the ETF.

*Previous efficiency is just not an indicator of future outcomes

The Backside Line for Traders

Excessive valuations are not any purpose to panic, however it’s essential to notice that they do make markets susceptible to disappointments or shocks. That’s why I consider the mantra needs to be one among cautious optimism. Let income run, however this can be a good second to critically assessment your holdings. Ensure you’re concentrated in corporations with stable fundamentals, companies which have tangible earnings, sturdy stability sheets, and actual aggressive benefits. Specifically, concentrate on companies that may convert innovation into income. It’s one factor for an organization to have a flashy new know-how or product; it’s one other for that innovation to truly generate sustainable earnings.

Whether or not we in the end get a textbook year-end rally or not is of little consequence to the affected person, long-term investor. If shares proceed to climb by December, that’s a welcome bonus. If the rally fizzles or a short lived pullback happens, it’s not the tip of the world; it might even be a possibility to choose up high quality belongings at barely higher costs.

Stay optimistic, however stay vigilant sufficient to guard your self from draw back. Cautiously optimistic is the candy spot. After a 12 months of sturdy returns, it’s a great time to calibrate your technique. The year-end rally can be good, and it might very nicely come to fruition. But when it doesn’t, do not forget that investing is an extended recreation. Those that keep level-headed and centered on fundamentals would be the actual winners when the mud settles and the following 12 months begins.

This communication is basic data and training functions solely and shouldn’t be taken as monetary product recommendation, a private advice, or a proposal of, or solicitation to purchase or promote, any monetary product. It has been ready with out taking your aims, monetary scenario or wants under consideration. Any references to previous efficiency and future indications will not be, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.