Greater than $700M flowed out of US spot Bitcoin ETFs in a single day this week, marking the sharpest pullback in two months. Let’s dive into why is crypto crashing?

In accordance with Bloomberg’s newest report on January 21, traders pulled roughly $709M from spot Bitcoin ETFs listed within the US. It was the largest day by day outflow since November 20.

The exit adopted a stretch of market stress sparked by President Donald Trump’s renewed tariff threats towards Europe.

His feedback raised contemporary fears of a broader commerce battle and pushed traders out of danger property throughout world markets.

DISCOVER: Subsequent 1000X Crypto – Right here’s 10+ Crypto Tokens That Can Hit 1000x This 12 months

What Does the Drop in Crypto Market Cap Say About Investor Sentiment?

Bitcoin slipped under $88,000 throughout Tuesday’s sell-off earlier than stabilizing within the upper-$89,000 vary.

The whole crypto market cap fell about 2–3% over 24 hours, holding simply above the $3 trillion mark.

The shift in flows stands in sharp distinction to early January, when spot Bitcoin ETFs pulled in about $1.4Bn in internet inflows over a single week.

The sudden reversal reveals how shortly sentiment has turned as commerce headlines and rising bond yields dominate the macro image.

Derivatives knowledge factors to de-risking quite than a full unwind. CoinGlass knowledge reveals Bitcoin futures open curiosity close to $58.5Bn, with about $63.5Bn traded prior to now 24 hours.

Liquidations sit round $110M, whereas Bitcoin trades near $89,500.

Throughout the broader crypto market, futures open curiosity is close to $132Bn, set towards $260Bn in day by day quantity.

Roughly $600M in positions had been cleared out over the previous day, suggesting cautious repositioning as an alternative of panic.

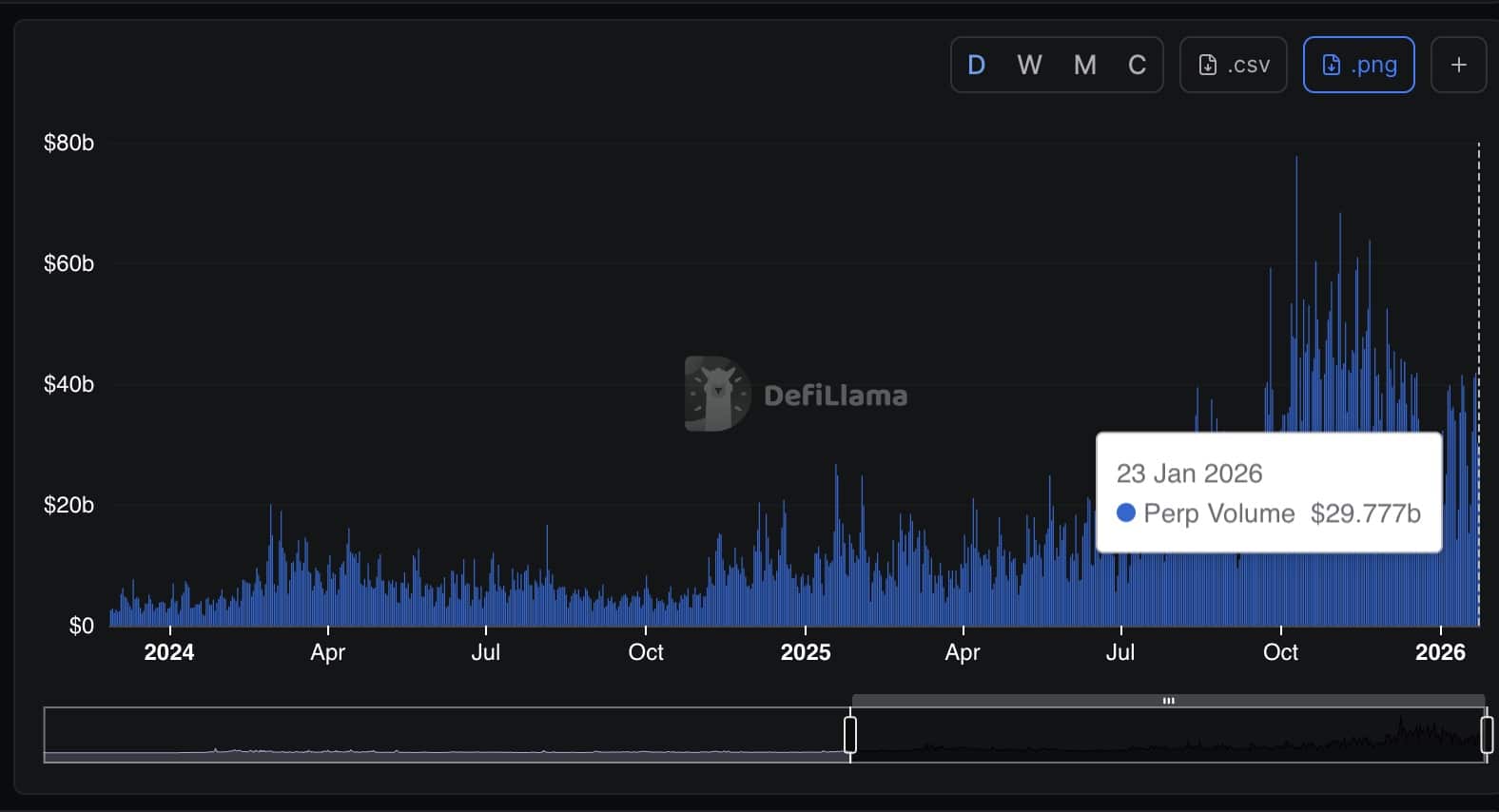

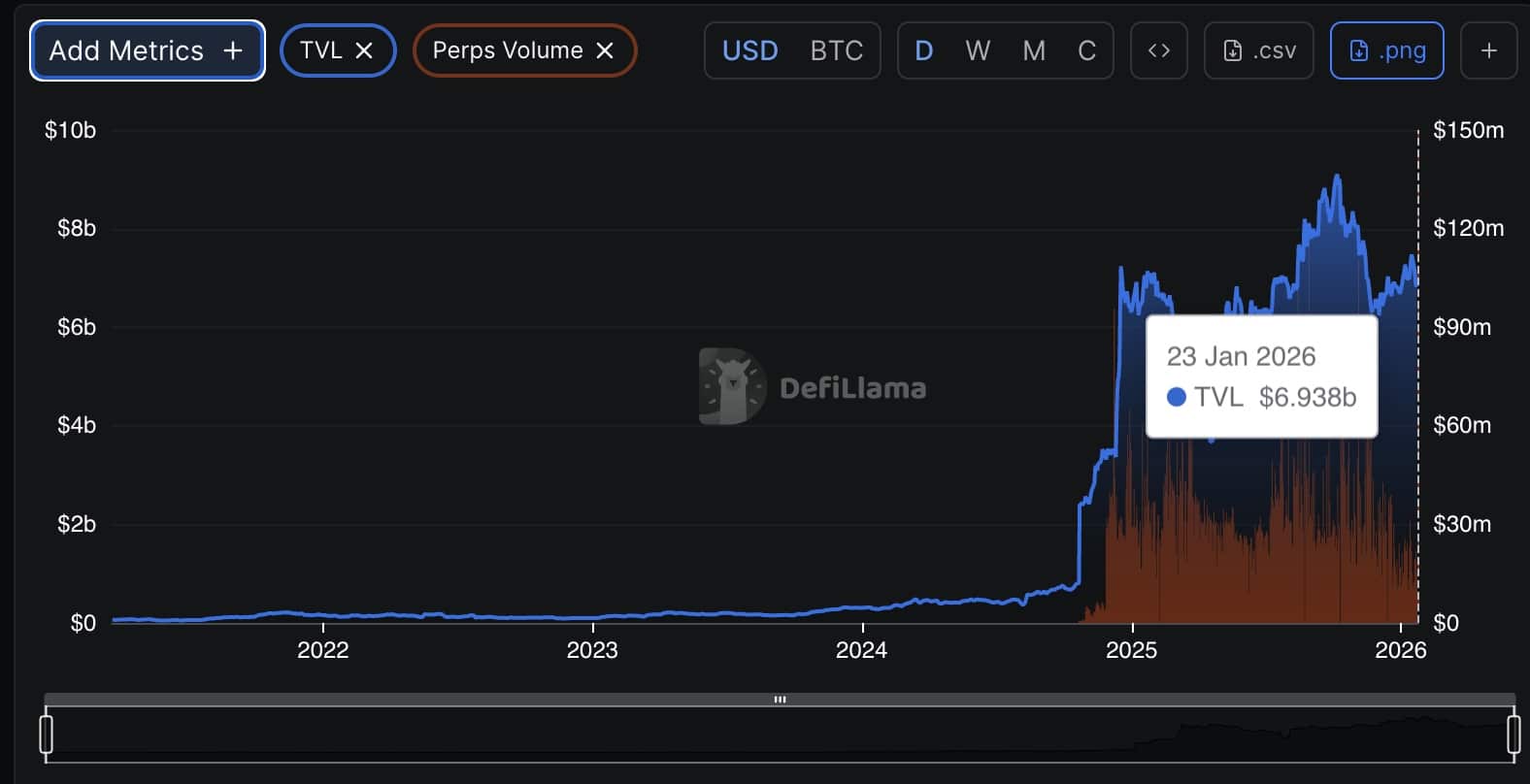

DefiLlama’s dashboard places perpetuals open curiosity simply above $19Bn, with $30.2Bn in 24-hour quantity a light drop from final week.

Bitcoin’s share of on-chain buying and selling stays small. Its native chain noticed about $0.7 million in spot DEX quantity and $15 million in perp flows, in contrast with practically $14.4Bn in spot trades throughout world DEXs.

DISCOVER: 16+ New and Upcoming Binance Listings in 2026

Do Rising Bitcoin Trade Inflows Sign Quick-Time period Promoting Stress?

Bitcoin’s on-chain flows shifted this week as extra cash moved towards promoting venues.

Knowledge cited by Ali Charts reveals about 15,000 BTC flowed into centralized exchanges over the previous seven days. At present costs, that stash is price roughly $1.35Bn.

15,000 Bitcoin $BTC, price roughly $1.35 billion, had been despatched to crypto exchanges over the previous week, in response to knowledge from @glassnode. pic.twitter.com/hxiXb6q8wY

— Ali Charts (@alicharts) January 23, 2026

On-chain knowledge from Glassnode reveals alternate balances rising once more after a short interval of regular outflows earlier this month.

Merchants often watch these inflows carefully as a result of they will level to contemporary promoting stress or short-term positioning.

The shift comes as Bitcoin trades close to necessary technical ranges, retaining sentiment cautious for now.

Ethereum’s efficiency towards Bitcoin has weakened.

The ETH/BTC pair slipped under its 200-day transferring common and its 200-day exponential transferring common on the day by day chart, exhibiting a transparent drop in longer-term momentum.

$ETH Misplaced the Every day 200MA/EMA relative to $BTC however continues to be holding on to that 0.032 degree.

Seeing value barely moved for the previous 3 months, I believe a big volatility enlargement is probably going.

Massive degree to defend right here for the bulls to be sure that transfer isn't towards them. pic.twitter.com/ExRRxAaeeo

— Daan Crypto Trades (@DaanCrypto) January 23, 2026

Even with that break, Ethereum continues to be holding the 0.032 degree towards Bitcoin. Merchants have handled this zone as a key line within the sand.

The pair has moved sideways for nearly three months, with little course and tight value motion. That type of compression typically indicators {that a} bigger transfer is constructing.

Market analysts say the 0.032 space stays the extent consumers want to guard. A agency drop under it might hand extra momentum to Bitcoin and will set the stage for a sharper shift within the development.

DISCOVER: 10+ Subsequent Crypto to 100X In 2026

Key Takeaways

In accordance with Bloomberg’s newest report on January 21, traders pulled roughly $709M from spot Bitcoin ETFs listed within the US. It was the largest day by day outflow since November 20.

Bitcoin’s share of on-chain buying and selling stays small. Its native chain noticed about $0.7 million in spot DEX quantity and $15 million in perp flows, in contrast with practically $14.4Bn in spot trades throughout world DEXs.

The publish Why Is Crypto Crashing? Report $700M Exits Bitcoin ETFs in Single Day as Wall Road De-Dangers Forward of Commerce Struggle appeared first on 99Bitcoins.